If new funding not identified such as if Nov. 2026 ballot measure sales tax increase doesn’t pass

East Contra Costa, North Concord, Orinda Stations could be shuttered

By BART

At the annual BART Board Workshop on Thursday, February 12, BART staff will present Directors with detailed plans for an alternative service framework if a November 2026 ballot measure fails and no other operating revenue source is identified. 10 stations could be closed by January 2027 and three segments by July 2027.

During the workshop, staff will outline the risks and tradeoffs for service and non-service reductions. Because rail has high fixed costs and low marginal savings, it is impossible to close the projected FY27 $376M deficit with service cuts and fare increases alone.

BART staff evaluated multiple aspects of service including routes, stations, headways, peak, evening, and weekend service and hours of operation. The proposed framework outlines, for the very first time, specific details including which stations would need to be closed due to a lack of operating funds and the recommended phased approach to triggering further cuts. The plan retains as many riders as possible, while still cutting service to realize savings. System support services would need to be reduced by 40% as cost savings from cutting service would be largely offset by the resulting lost fare revenue.

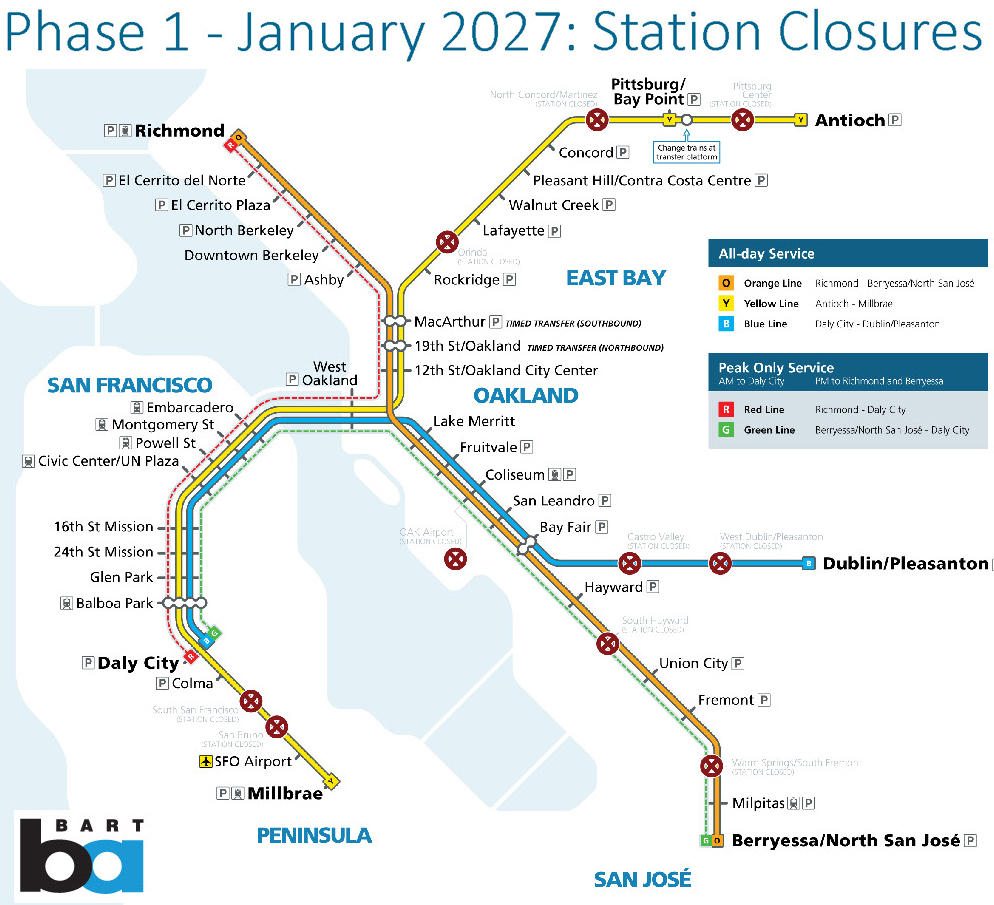

Phase 1 – North Concord, Orinda, Pittsburg Center Stations Would Close

The stations on the list for potential Phase 1 closure in January 2027 include the 10 lowest ridership stations: North Concord, Orinda, Pittsburg Center, Oakland International Airport, West Dublin/Pleasanton, Castro Valley, San Bruno, South Hayward, South San Francisco and Warm Springs/South Fremont.

In addition, the proposed Phase 1 proposal includes Service Frequencies of a 63% reduction in train hours; Reduced base schedule: 3-line base schedule each with 2 trains/hour and 240% more transfers (Percentage of trips requiring a transfer increases from 7% to 22%); Test retaining peak service: Peak Green/Red/Yellow trains operate in peak hours/direction only; and No evening service: the lines would Close at 9 PM (7 days) and Open at 8 AM (Saturday and Sunday).

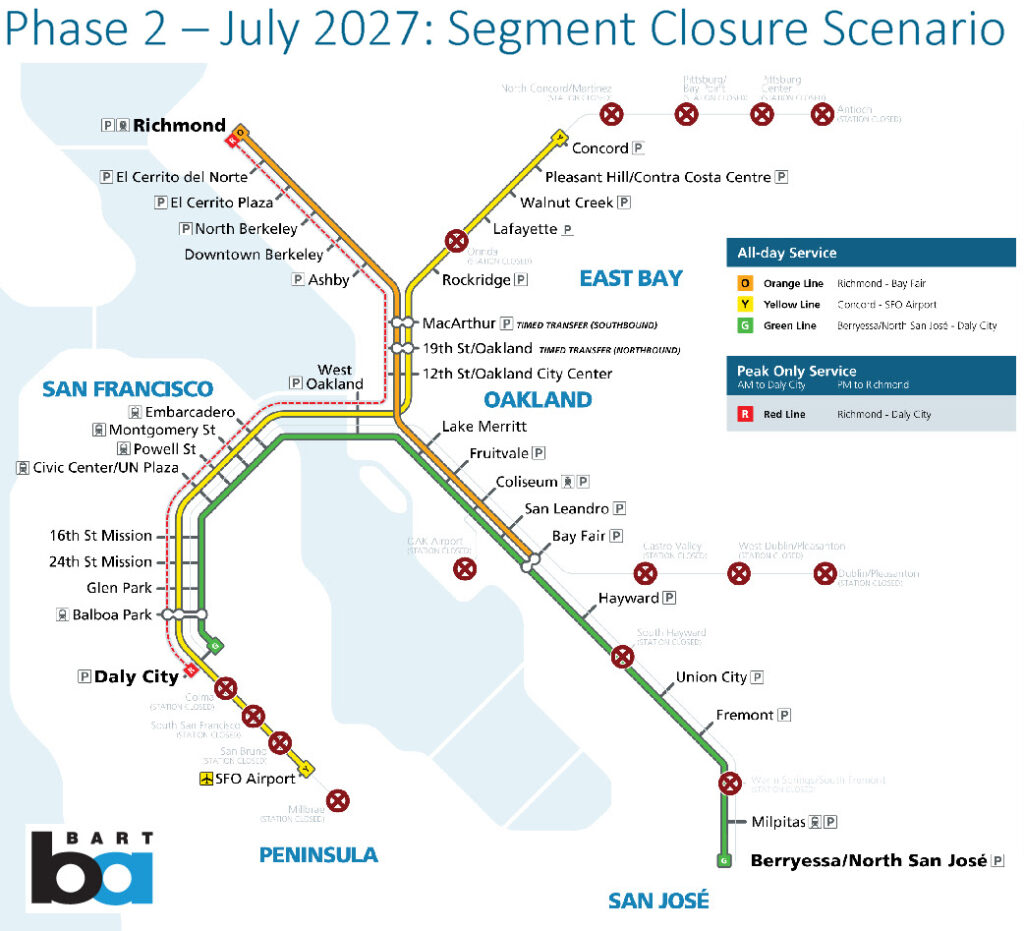

Phase 2 – Yellow Line Service Would End at Concord Station, Pittsburg/Bay Point & Antioch Stations Would Close

The Phase 2 – July 2027: Segment Closure Scenario, Contingent on Phase 1 implementation, would result in a 70% reduction in train hours and 25% reduction in system miles; Segment closures would stop service on most system segments opened after 1976: Yellow line service would end at Concord, shuttering the Pittsburg/Bay Point and Antioch Stations; Orange line service would end at Bay Fair,; Blue line service would be discontinued shuttering the West Dublin/Pleasanton Station; Most stations south of Daly City would be closed except for direct service to SFO would continue for revenue retention; Service continues to Milpitas and Berryessa due to terms of BART/VTA agreements.

Board Vote Scheduled for Feb. 26 Meeting

There will not be a Board vote at the workshop on February 12. After receiving feedback from Directors at the workshop, staff plans to return to the Board on Thursday, February 26, with a resolution to adopt a finalized alternative service framework that would be implemented if new funding is not secured.

You can read the full presentation here.

You can participate in the workshop. You may join in person (2150 Webster Street, Oakland, CA 94612) or via Zoom videoconferencing (https://us06web.zoom.us/j/89025424156).

Written comments may be addressed to the BART Board in advance via email to Board.Meeting@BART.gov, using “public comment” as the subject line, before 3:00 p.m. on Wednesday, February 11th.