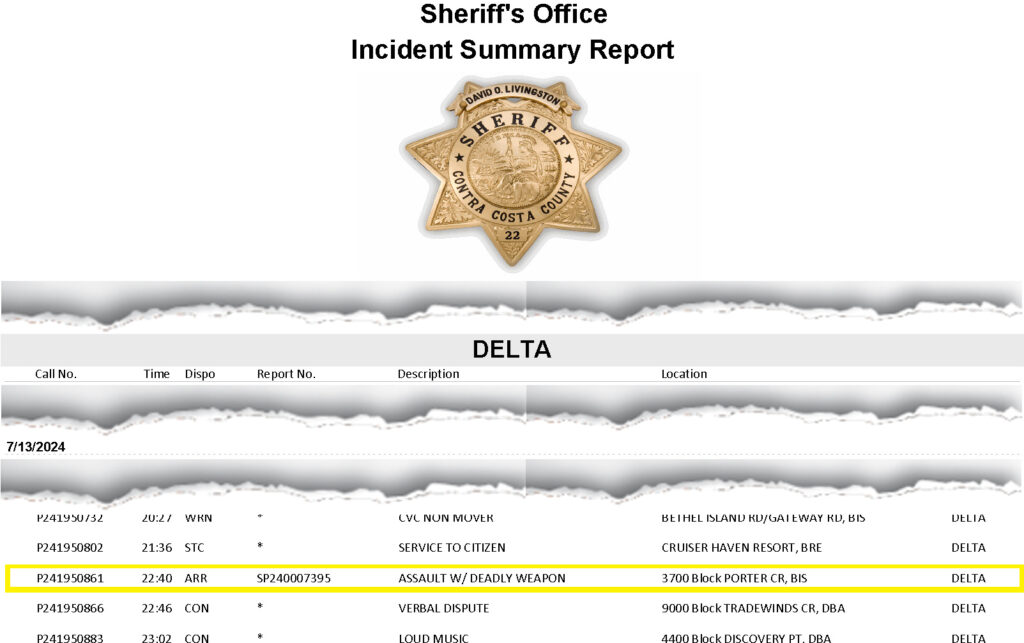

The CCC Sheriff’s Office Incident Summary for July 13, 2024, shows the response to the call regarding the alleged assault by Zachary Taylor on Sunday night at 10:40 p.m. Source: CCC Sheriff’s Offic

“I have not used my position to seek any special treatment or favors for myself or my family.” – Susannah Meyer

By Allen D. Payton

Brentwood Vice Mayor Susannah Meyer took to social media on Tuesday, July 16, 2024, to respond to rumors surrounding the arrest of her son on Saturday and dispel accusations that she received special treatment. The now candidate for mayor in the November election wrote on her official Facebook page, “I have not used my position to seek any special treatment or favors for myself or my family.”

According to localcrimenews.com, Zachary Taylor was arrested for “assault with any means of force likely to produce great bodily injury”. According to the Contra Costa County Sheriff’s Office Incident Summary Report for July 13, 2024, it occurred at 10:40 PM in the 3700 block of Porter Circle on Bethel Island inside a mobile home park and is listed as assault with a deadly weapon.

Sheriff’s spokesman Jimmy Lee later confirmed that information when he shared, “On Saturday, July 13, 2024, at about 10:40 PM, Deputy Sheriffs responded to a report of a battery at a residence on the 3700 block of Porter Circle in Bethel Island. Deputies contacted a person who had been physically assaulted. The victim was transported to a local hospital. The suspect was later taken into custody after returning to the scene. He is identified as 30-year-old Zachary Meyer of Bethel Island. He was booked into the Martinez Detention Facility for an assault with a deadly weapon charge. He was being held in lieu of $30,000 bail but has since bailed out.”

Also, according to Contra Costa County Sheriff’s Office Zachary Meyer was booked early Monday morning, July 14 and was released on bond early Monday afternoon.

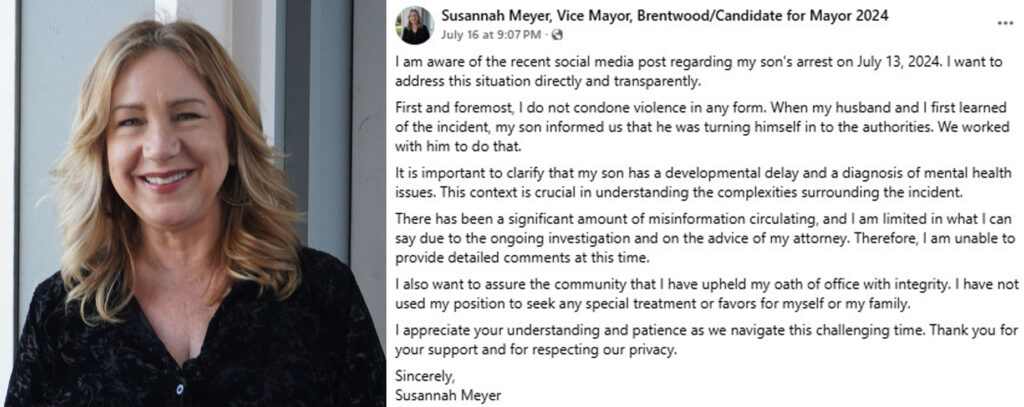

Susannah Meyer in a photo on her official Facebook page on Aug. 8, 2023, and the post on Tuesday, Aug. 17, 2024, about her son’s arrest.

In her post the councilwoman wrote, “I am aware of the recent social media post regarding my son’s arrest on July 13, 2024. I want to address this situation directly and transparently.

First and foremost, I do not condone violence in any form. When my husband and I first learned of the incident, my son informed us that he was turning himself in to the authorities. We worked with him to do that.

It is important to clarify that my son has a developmental delay and a diagnosis of mental health issues. This context is crucial in understanding the complexities surrounding the incident.

There has been a significant amount of misinformation circulating, and I am limited in what I can say due to the ongoing investigation and on the advice of my attorney. Therefore, I am unable to provide detailed comments at this time.

I also want to assure the community that I have upheld my oath of office with integrity. I have not used my position to seek any special treatment or favors for myself or my family.

I appreciate your understanding and patience as we navigate this challenging time. Thank you for your support and for respecting our privacy.

Sincerely,

Susannah Meyer”

Efforts to reach the councilwoman for additional details about her son were unsuccessful prior to publication time. Please check back later for any updates to this report.