The Cal State East Bay Pioneers men’s basketball team and coaches celebrate their conference championship Saturday night, March 7, 2026. Photo source: Cal State East Bay

Heads to NCAA DII Tournament

UNBEATEN. UNTOUCHED. UNSTOPPABLE.

Watch NCAA seed Selection Show Sunday night

By Kimberly Hawkins, Senior News and Media Manager/PIO, Cal State East Bay

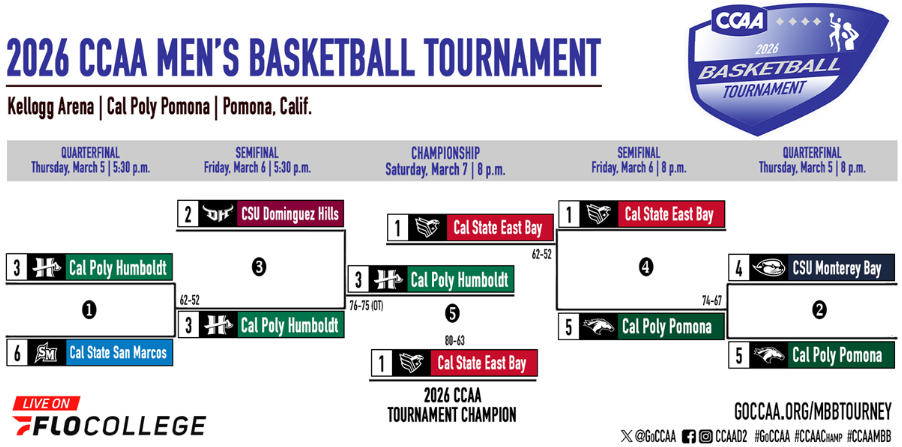

The Cal State East Bay men’s basketball team continued their historic run, clinching the California Collegiate Athletic Association (CCAA) Tournament title with an 80-63 win over Cal Poly Humboldt. The Pioneers improved to 30-0 on the season, captured their first tournament championship and earned their first ever berth into the NCAA DII Tournament.

The Cal State East Bay men’s basketball team continued their historic run, clinching the California Collegiate Athletic Association (CCAA) Tournament title with an 80-63 win over Cal Poly Humboldt. The Pioneers improved to 30-0 on the season, captured their first tournament championship and earned their first ever berth into the NCAA DII Tournament.

East Bay set the tone early, opening the game with a layup from guard Jaayden Bush just seconds into the contest. The Pioneers quickly built a lead behind strong interior play from Josh Ijeh, who converted a tip-in and free throw to give East Bay an early five-point advantage. Cal Poly Humboldt answered with a brief run midway through the half, but the Pioneers continued to respond with balanced scoring and strong defense.

Key contributions from the East Bay bench helped swing momentum in the first half. Takai Emerson-Hardy threw down a dunk and added another basket inside, while Jordan Espinoza converted a layup late in the period. Bush added a fast-break layup and knocked down free throws in the closing seconds to help the Pioneers take a 35–27 lead into halftime.

East Bay extended its advantage immediately after the break as Tyree Campbell knocked down a three-pointer to push the lead into double digits. Bush followed with a three of his own, and Campbell connected again from beyond the arc to keep the Pioneers firmly in control. The Lumberjacks briefly cut the deficit to single digits midway through the half, but East Bay answered with a decisive run fueled by defensive stops and second-chance opportunities.

Bush led all scorers with a season high 23 points, shooting 7-of-14 from the field while adding five rebounds and two steals. Bush, a junior, was named CCAA Tournament MVP. Jalen Foy finished with 13 points and five rebounds, while Ijeh dominated the glass with a game-high 15 rebounds to go along with 12 points for a double-double. Campbell added 11 points on three made three-pointers and contributed three assists and two steals. Ijeh and Campbell both earned All-Tournament team honors.

Cal State East Bay men’s basketball team Head Coach Bryan Rooney cuts down the net following the championship game on Saturday, March 7, 2026. Photo source: Cal State East Bay

East Bay’s depth also played a key role in the championship victory. Amare Campbell dished out a team-high six assists and scored five points, Emerson-Hardy added four points and three rebounds, and Terence Haywood chipped in three points off the bench. The Pioneers controlled the boards with a 41–36 rebounding advantage and outscored Humboldt 36–30 in the paint while forcing turnovers that led to transition opportunities.

With the win, Cal State East Bay improves to a perfect 30–0 on the season and claims the CCAA Tournament title, completing a dominant run through the conference tournament and continuing one of the most remarkable seasons in program history.

CSUEB remains the only undefeated team in NCAA Division II and earns the CCAA’s automatic bid, as the No. 1 seed, to the NCAA West Regional, which begins next Friday (Mar. 13). Cal State East Bay will learn its opponent and seed during the NCAA Selection Show tonight (Mar. 8) at 8 p.m. on NCAA.com.

30–0. Conference Champions. History Made.

See Championship Game video, game photos and the post-game press conference video.

For more information about the school with campuses in both Concord and Hayward visit www.csueastbay.ed.

Read MoreInclude Assessor, Auditor-Controller and County Superintendent of Schools

By Allen D. Payton

Because the incumbent didn’t file to run for re-election in the June 2nd primary by Friday, March 6, the filing period has been extended five business days in three county-wide offices.

According to the Contra Costa County Clerk-Recorder’s Office Elections Division the deadline for filing nomination documents has been extended (to non-incumbents only) to March 11, 2026, for the following County offices: Assessor, Auditor-Controller and County Superintendent of Schools.

Candidates must obtain their documents and file between 8:00 a.m. and 5:00 p.m. at 555 Escobar Street in Martinez.

For more information visit www.contracostavote.gov/elections/candidates-campaigns-measures/run-for-office, email candidate.services@vote.cccounty.us or call (925) 335-7800 and ask for Candidate Services.

Read More

The Grocery Outlet store on Buchanan Road in Antioch and the stores in Oakley and Brentwood will remain open. Photo by Allen D. Payton

Company announced this week underperforming stores will close this year

By Allen D. Payton

Emeryville-based Grocery Outlet announced this week that they plan to close 36 of their 536 stores across the United States this year, including nine in California. However, it was learned Friday, that the Antioch store is not on the list. In addition, according to a news report about a list from a commercial real estate company that has locations for lease, so far, the other five stores in Contra Costa County are also not on the list of closures. Those include stores in Brentwood, Oakley, Pinole, Richmond and San Pablo.

Included in the Grocery Outlet Holding Corp.’s Fourth Quarter and Fiscal 2025 Financial Results, the Company announced on Tuesday, March 4, 2026, “a business optimization plan (the ‘Optimization Plan’) to improve operational execution, strengthen long-term profitability and increase cash flow generation.”

Net sales for the year increased by 7.3% to $4.69 billion, gross profit increased 7.4% versus 2024 to $1.42 billion and gross margin was 30.3% compared to 30.2% in 2024. But the company’s operating loss was $221.7 million and net loss was $224.9 million compared to net income of $39.5 million, in 2024. Adjusted net income was $75.2 million compared to $76.3 million the previous year.

“We made progress on our strategic priorities in 2025; however, our fourth-quarter results made clear that we have more work to do, and we’re moving quickly,” said Jason Potter, President and CEO of Grocery Outlet. “Consumer pressure intensified, federally funded benefits were delayed, and competition grew more promotional in the fourth quarter. In response, we have begun to sharpen our focus on what matters most: delivering clearer value and a better in-store experience. We’re intensely focused on restoring the opportunistic mix to rebuild value perception with the customer and advancing our store refresh program, and we’re already seeing early, measurable improvements. At the same time, we’re closing underperforming stores, reshaping our new store growth strategy and reallocating resources to strengthen operating results and returns on capital. We are confident that we have identified the core challenges and now have the right plans in place and the right team to execute them.”

Optimization Plan and Restructuring Plan

As a result, the company announced those plans as follows:

“To strengthen long-term profitability and cash flow generation, improve operational execution, optimize our existing store footprint and align with our disciplined new store growth strategy, in the first quarter of fiscal 2026 we conducted a strategic, financial and operational analysis of our store fleet. Following that review, on March 2, 2026, our Board of Directors adopted the Optimization Plan that provides for the closure of 36 financially underperforming stores, including the termination or sublease of the applicable store leases, the termination or sublease of a lease for a distribution center facility that we are no longer utilizing, and the termination of operator agreements with independent operators (‘IOs’) for the applicable store locations as well as certain other store locations. These actions under the Optimization Plan are expected to be substantially completed during fiscal 2026.”

Grocery Outlet Partners with Independent Owner/Operators

According to the company’s website, “Since 1973, Grocery Outlet has partnered with retail leaders to operate their expanding locations. Our Independent Operators have considerable local-decision making autonomy over store operations including hiring, merchandising, marketing and more. You hire, train, and lead your team, doing what you do best, and then we share the profits of your retail store according to our commission structure. We each assume different risks but share the rewards.

“We support our Independent Operators with training, mentorship, marketing, finance and accounting professionals to assist with any questions or issues that come up.”

Contra Costa County Stores Not Closing

Kyle Noble, Grocery Outlet’s Senior Director of Marketing was asked if it is correct that stores in California are closing and if so, whether or not Antioch is included.

He was also asked since no list has apparently yet been publicly provided, when it will be, how long will the current owner/operators be given to prepare for their closures or if they have already been informed. Noble did not respond before publication time.

However, a store employee who chose not to be identified, informed the Herald the Antioch store located on Buchanan Road will not be closing.

Open since Nov. 12, 2015, the current owner/operators are Fadi Fayad and Kelly Talaie.

A report on Patch provided the list of the nine California stores to close which doesn’t include the six locations in Contra Costa County. The stores to close are in Azusa, Brawley, El Cajon, Kerman (near San Jose), La Habra, Ontario, Patterson, Poway and Ridgecrest.

The other two stores in East County include: Brentwood, located at 7610 Brentwood Blvd., has been open since October 6, 2021, and the current owner/operators are Greg and Lori Pitts. The Oakley store, located at 3110 Main Street, which has been open since March 26, 2015, and the current owner/operators are Matt and Karen Amaro.

In West County: the Pinole store, located at 1460 Fitzgerald Drive, has been open since June 10, 2010, and the current owner/operators are Sam and Asifa Ahmad. The Richmond store, located at 12010 San Pablo Avenue, has been open since May 23, 2013, and the current owner/operators are Sopheap and Sokna Yin. The San Pablo store is located at 2079 23rd Street, has been open since January 2, 1989, and the current owner/operators are Chivy Thath and Sophal Sok.

24 Stores to Close on East Coast

According to a KRON4 news report, “While no announcement has been made as to which stores will close…According to a report in the grocery industry trade publication, Grocery Drive, 24 of the stores set to close are on the East Coast.”

The company “currently operates around 17 stores in the Bay Area” and “more than half of Grocery Outlet stores are in California,” according to the report.

About Grocery Outlet:

Based in Emeryville, California, Grocery Outlet is a growth-oriented extreme value retailer of quality, name-brand consumables and fresh products sold primarily through a network of independently operated stores. Grocery Outlet and its subsidiaries have more than 560 stores in California, Washington, Oregon, Pennsylvania, Tennessee, Idaho, Nevada, Maryland, Ohio, New Jersey, North Carolina, Georgia, Alabama, Delaware, Kentucky and Virginia.

Please check back later for any updates to this report.

Read MoreAnnounces retirement after 40 years in public office effective Dec. 2026 at end of current term

Supports Assistant County Assessor Vince Robb as his replacement

By Robin Cantu, Assessor’s Customer Services Coordinator, Contra Costa County Assessor’s Office

On Friday, March 6, 2026, Contra Costa County Assessor Gus Kramer announced he would not run for re-election to a ninth term. He first served in public office as the Martinez City Clerk when he was elected in 1986.

The announcement reads, he “will retire from his position as County Assessor in December 2026, concluding more than three decades of dedicated public service to the residents of Contra Costa County

“First elected in 1994, Kramer has been entrusted by the voters of Contra Costa County for eight consecutive terms over the past 32 years. During that time, he has overseen significant modernization and improvements within the Assessor’s Office, working to ensure that property assessments are conducted with fairness, transparency, and efficiency.

“It has been the honor of a lifetime to serve the people of Contra Costa County,” said Kramer. “I am deeply grateful to the voters who placed their trust in me eight times over the past three decades. Their confidence and support have meant a great deal to me throughout my career.”

Kramer also emphasized the contributions of several key members of his leadership team who have played an essential role in strengthening the office’s service to the public. He expressed special appreciation to Vince Robb, Assistant County Assessor; Peter Yu, Assistant County Assessor; and Robin Cantu, Assessor’s Customer Services Coordinator, for their outstanding dedication and leadership.

“Vince Robb and Peter Yu have been exceptional partners in managing the complex responsibilities of the Assessor’s Office, bringing professionalism, expertise, and a strong commitment to public service every day,” Kramer said. “Robin Cantu has also been instrumental in ensuring that our office maintains a high level of responsiveness and service for the public.”

Kramer noted that their leadership—along with the dedication of the entire Assessor’s Office staff—has helped bring the efficiency, professionalism, and public service of the office to an all-time high level.

“I want to thank every member of the Assessor’s Office, past and present, who has worked so hard to serve the residents of Contra Costa County,” Kramer added. “Together we have worked to make the business of property value assessment as simple, transparent, and accessible as possible for the public.”

As he prepares for retirement, Kramer said he is proud of what the office has accomplished and grateful for the opportunity to serve the community.

“Public service has been a privilege, and I will always be thankful for the trust placed in me by the people of Contra Costa County,” Kramer said.

Supports Assistant County Assessor Vince Robb

Asked on Friday if he had groomed someone to take his place, Kramer said, “The Assistant County Assessor, Vince Robb, in my office is a good choice. Nobody has experience or credentials like Vince. He has 20 years’ experience in the Assessor’s Office. The other two have never appraised a single property.”

He was referring to Nick Spinner, whose ballot designation is Senior Systems Engineer in the Contra Costa Elections Division list of candidates for the June 2nd primary election, and Kismat Kathrani, whose designation is Software Technology Entrepreneur.

About Kramer

In the bio on his campaign website which is still up as of Saturday, March 7th, Kramer wrote, “I was born in Contra Costa and raised in East County. My high school was Pacifica High in West Pittsburg (Go Spartans!) and I graduated in 1968. Back then the area was called West Pittsburg, but now it is called Bay Point. It was a small high school but we played hard in local sports and competed well against larger central county schools. It closed in 1976 and is now Riverview Middle School on Pacifica Ave. Having a high school of our own, rather than sending kids to Concord or Pittsburg, was a real anchor for the community.

“After high school I attended DVC for a year, then went to mortuary school in San Francisco. Working in mortuary and funeral services is a very specific calling. It is not for everyone, but for those that answer the call it can be fulfilling. It taught me a deep respect for life, caring for the living, and humbleness in the face of the awesome hereafter. Working as an embalmer introduced me to the CC Coroner’s office, and I worked there for several years. It might be how I keep my sense of humor when things are gloomy. I continued my education at USF studying public administration at night, while I worked for the county. This began my career in public service.

“I settled and raised my family in Martinez, the County Seat of Contra Costa. the adopted home town of environmentalist John Muir and the birthplace of baseball hero Joe DiMaggio. I still live there today.

“Bitten is a strong word for it, so maybe I was nipped by the political bug in the mid-80s in Martinez. I wanted to be involved in my community, give back, and continue to serve. I ran for City Clerk and won. As clerk I was not voting on issues like the city council, but I was part of the process and aware of the machinations of local government. As city clerk I donated my monthly salary to provide scholarships to local students. Education helped my rise up and build a foundation, and I wanted to give back to the community rather than take from it.”

Official County Bio

According to his official 2022 bio on the Contra Costa County website, “Gus grew up in Bay Point, California, and is a graduate of the San Francisco College of Mortuary Science and the University of San Francisco.

His public career in Contra Costa County began in 1974. Kramer embarked on his tenure with the County at the Contra Costa County Sheriff Coroner’s Office, later moving to the Contra Costa County Probation Department, and finally to the Contra Costa County Public Works Department until 1994 when he was elected to the position of County Assessor. In addition to his service to Contra Costa County and its residents, Kramer was also elected to the position of Martinez City Clerk in 1986.

“As County Assessor, Kramer has overseen remarkable improvements to streamline the operations of his office, eliminate backlogs, and achieve higher levels of public service, all while operating substantially under budget.

“The State Board of Equalization acknowledged his office as one of the best managed assessor’s operations in California. Gus Kramer is a member of the California Assessors’ Association and the International Right of Way Association and has more than 43 years as a licensed real estate salesperson.”

He now has been a licensed real estate agent for 47 years, since 1979, Kramer said.

During his work for the County Public Works Department real estate division he shared, “I valued commercial and residential real estate to be purchased for public works projects.”

Future Plans

Asked what his plans are for the future, Kramer exclaimed with a laugh, “I gotta find something to do!”

Seriously, he said he will find something where he can apply his skills, knowledge and experience, probably in real estate.

Read MoreBy Allen D. Payton

Join the NAACP Richmond, CA Branch for its annual Community Engagement Recognition Banquet at Contra Costa College this Saturday, March 7th. Refreshments at 3:30 p.m., Program at 4:30 p.m.

Contra Costa County District 1 Supervisor John Gioia will be among those honored during the event.

“I’m honored to be one of the individuals to be recognized for my work in advancing equity and justice,” he wrote in a Facebook post on Thursday.

The Richmond NAACP has been fighting discrimination and working for equity and justice since 1944. For more information visit NAACP – RICHMOND BRANCH.

Read MoreDeadline: March 11th

By Juliet V. Casey Geary, Director of Marketing & Media Design, Los Medanos College

We are pleased to announce the call for nominations for the 2026 César Chávez Awards is open. The awards celebrate the life of labor leader and human rights activist César Chávez and recognize East Contra Costa County community members who follow his example of service, activism and non-violent social change.

Nomination form and event details are available on the event web page. Nomination deadline is Wednesday, March 11.

See our call-to-action video.

Save the date for the awards ceremony, which this year will be held at 6 p.m. on Friday, April 3 in the Student Union at the LMC Pittsburg Campus, 2700 E. Leland Road. The event is free and open to the public, though space is limited.

Values of César Chávez:

- Service to Others: Empowering individuals by engendering self-determination, self-sufficiency and self-help, rather than charity.

- Sacrifice: Recognizing the obligation every individual has to contribute to their community, despite having to endure great hardship.

- Help the Most Needy: Supporting efforts to reach those in need, those dispossessed, and those most forgotten individuals.

- Determination: Instilling an attitude that through steadfast commitment, patience, and optimism, people can overcome great adversity.

- Non-violence: Achieving social and economic justice and equality through bold and courageous action.

- Tolerance: Promoting and supporting ethnic and cultural diversity as a means toward informing and strengthening communities.

- Respect for Life: Holding land, people, and all other forms of life in the highest regard.

- Celebrating Community: Sharing expressions of cultural identity through art, song and dance.

- Knowledge: Pursuing self-directed learning, the development of critical thinking, and constructive problem-solving.

- Innovation: Creating strategies and tactics to resolve problems and situations that often seem insurmountable.

Awards recognize recipients in the following categories:

César Chávez Award for Exemplary Community Service

The César Chávez Award for Exemplary Community Service recognizes a local resident who demonstrates a long-standing commitment to service and who best represents the core values modeled by César Chávez: Service to Others, Sacrifice, Help the Most Needy, Determination, Non-Violence, Acceptance of All People, Respect for Life and the Environment, Celebrating Community, Knowledge and Innovation.

East County Educator Award

The César Chávez East County Educator Award recognizes a member of the educational community who demonstrates the qualities of César Chávez and a commitment to student success and equity, particularly for students of color and those from low-income families.

Chávez Spirit Award

The César Chávez Spirit Award recognizes an emerging student leader who embodies the spirit of César Chávez and who within the past year affected change in the areas of advocacy and social justice.

About Los Medanos College (LMC): LMC is one of three colleges in the Contra Costa Community College District, serving the East Contra Costa County community. Established in 1974, LMC has earned federal designations as a Minority-Serving and Hispanic-Serving institution. It offers award-winning transfer and career-technical programs support services, and diverse academic opportunities in an inclusive learning environment. With exceptional educators, innovative curriculum, growing degree and certificate offerings, and state-of-the-art facilities, the college prepares students to succeed in their educational pursuits, in the workforce, and beyond. LMC’s Pittsburg Campus is located on 120 acres bordering Antioch, with an additional education center in Brentwood.

Read More51-year-old Jonathan Dean Bishop victimized three minors under 14, one was under age 10 over more than 16 years; faces multiple life sentences

By Ted Asregadoo, PIO, Contra Costa District Attorney’s Office

Martinez, California – On Monday, March 2, 2026, a Contra Costa County jury convicted a former Walnut Creek real estate attorney on 27 felony counts related to the sexual abuse of children and the possession of child sexual abuse material.

Jonathan Dean Bishop, 51, (born 1/21/1975) faces multiple life sentences after being convicted on 24 counts of committing lewd acts upon three minor victims, each under the age of 14, identified in court documents as Jane Doe #1, Jane Doe #2 and Jane Doe #3. The convictions carry sentencing enhancements and cover the following periods:

- Jane Doe #1: June 2012 – June 2021

- Jane Doe #2: February 2012 – February 2021

- Jane Doe #3: September 2004 – September 2014

Moreover, the jury convicted Bishop of sexually abusing Jane Doe #1, who was under 10 years old at the time, with the abuse occurring between June 5, 2010, and June 4, 2018. He was also found guilty of possessing over 600 images of child sexual abuse material depicting two of the minor victims — evidence recovered from a hard drive seized by police officers at Oakland International Airport on December 13, 2023, when Bishop was taken into custody upon arriving from Florida, where he had been residing and practicing law.

“The bravery shown by these victims was extraordinary, and their courage made this conviction possible,” said Contra Costa District Attorney Diana Becton. “We are grateful for the outstanding work of law enforcement and the Internet Crimes Against Children Task Force, whose forensic and investigative efforts were critical to this case. I am also proud of our entire trial team — the Deputy District Attorney who prosecuted the case, our legal clerks, witness coordinators, victim advocates, and investigative staff — whose dedication and professionalism were evident every step of the way. Our office will always stand with the most vulnerable members of our community and remain committed to holding those who harm children accountable.”

According to the State Bar of California, Bishop was admitted to the on Dec. 1, 2004, became Inactive on Feb. 1, 2025, then on July 1st, last year he was deemed “Not eligible to practice law in CA” based on the Administrative Action of being Administrative Inactive for Client Trust Account Protection Program noncompliance.

According to his bio on AVVO.com, “Mr. Bishop received a Bachelor of Arts degree from San Diego State University in 2000, and his law degree from Golden Gate University School of Law in 2004. Before becoming an attorney, Mr. Bishop worked in the education and investment banking industries. While in law school, Mr. Bishop interned with the San Francisco Public Defenders Office, an international intellectual property law firm located in Bangkok, Thailand and worked for the State Bar of California’s Office of Professional Competence. Mr. Bishop was also an author of the ‘Ethics Update’ article for the State Bar of California, Calbar Journal from 2002 thru 2004.”

According to lawyerdb.org, his practice areas included, “Real Estate Litigation, Construction Defects Litigation, Condominium, Construction Litigation, Real Estate/Construction Transactions, Business Litigation, Boundary Disputes, Real Estate, Conveyancing, Conservation Easements, Easements, Land Acquisitions, Business Law, Construction, Contracts, Corporate and Litigation.”

According to the Contra Costa County Sheriff’s Office, the five-foot, seven-inch tall, 169-pound Bishop is Hispanic, but also listed as White, and being held in the Martinez Detention Facility on no bail. His next court appearance is scheduled for April 17 at 8:30 AM in Bay Court, Richmond, Dept. 02.

Case No. 01-23-03948 | The People of the State of California v. Jonathan Dean Bishop

Allen D. Payton contributed to this report.

Read More

Richmond Police confront Angel Alexander Montaño Magallan holding two knives as he emerges from his apartment before the fatal shooting on Aug. 4, 2025. Video capture source: Richmond PD

By Ted Asregadoo, PIO, Contra Costa District Attorney’s Office

Martinez, California – A public report on a 2025 fatal use-of-force incident involving Richmond Police has been released by the Contra Costa District Attorney’s Office.

Martinez, California – A public report on a 2025 fatal use-of-force incident involving Richmond Police has been released by the Contra Costa District Attorney’s Office.

The report is the final step in a countywide protocol wherein the District Attorney’s Office conducts an independent investigation into an officer-involved fatal incident. Contra Costa District Attorney Diana Becton said, “The release of this report reflects my office’s commitment to transparency and accountability in the review of officer-involved shootings. We believe the public deserves a clear and thorough account of the facts surrounding these incidents, and that making our findings available to the community is essential to maintaining public trust.”

On August 4, 2025, at approximately 5:02 p.m., Richmond Police Department Dispatch received a 911 call regarding 27-year-old Angel Alexander Montaño Magallan. The caller, Magallan’s brother, reported that Magallan was armed with a knife and threatening to kill him and their mother. He also disclosed that Magallan had a history of mental illness and was living with the family in an apartment in the City of Richmond.

Multiple Richmond Police officers responded to the call and staged nearby to form a response plan. While waiting for additional resources, officers were advised that the family members could not leave the home because Magallan was blocking the front door, creating additional concerns of a possible hostage situation.

Video capture of Magallan emerging from his apartment with two knives in his hands. Source: Richmond PD

Moments later, dispatch advised officers that Magallan armed himself with two knives, prompting officers to move closer to the residence so they could quickly respond to a possible attack. As they approached, Magallan’s mother yelled out from inside the home, which caused officers to believe Magallan may be actively stabbing family members inside the home.

Upon opening the front door of the residence, Officer Nicholas Remick observed Magallan standing over his brother and mother while holding an object in his hand. Magallan immediately advanced toward Officer Remick, who could now see that Magallan was wielding a knife in each hand. Officer Remick repeatedly ordered Magallan to “stop” and retreated from the doorway, but Magallan continued to advance. It was not until Magallan had closed to within 5 to 10 feet — near enough to deliver a fatal knife strike to a retreating officer — that Officer Remick and Officer Stocking discharged their firearms, fatally striking Magallan. Officers then entered the apartment and confirmed that the remaining family members were physically unharmed.

After a review of all available facts surrounding the incident, the District Attorney’s Office finds that the use of deadly force was reasonable under the circumstances. As such, no further action will be taken in this case.

The District Attorney’s Office has sent a copy of the report to the Richmond Police Department, the California Department of Justice, and is available to the public on the Contra Costa District Attorney’s website.

See Richmond PD press release of incident, Critical Incident Video, plus, videos of officer body cam footage and other information, here.

Read More

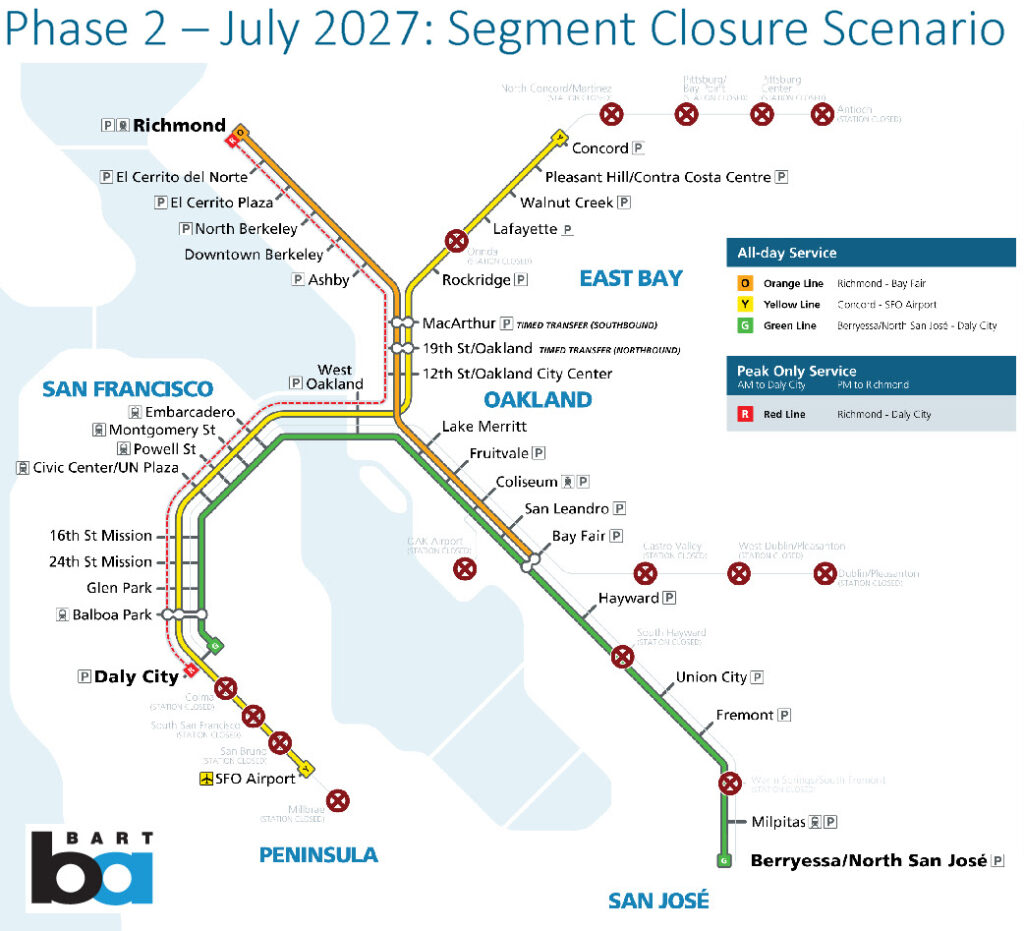

The BART Board voted to close four stations in Contra Costa County if the proposed Nov. sales tax measure fails. Source: BART

Contra Costa’s 4 representatives vote to adopt Alternative Service Plan to balance budget including 1,170 employee layoffs

Ridership still down 50% post-COVID

By Allen D. Payton

On Thursday, Feb. 26, 2026, the BART Board of Directors, on vote of 8-1, adopted an Alternative Service Plan outlining specific budget balancing details to solve a $376M deficit for the next fiscal year if no new funds become available to BART. According to a District press release, BART is facing a structural deficit of $350M to $400M because ridership is still down 50% compared to pre-pandemic levels and BART’s current funding model relies heavily on passenger fares.

As previously reported by the Herald, the stations on the list for potential Phase 1 closure in January 2027 include the 10 lowest ridership stations: North Concord, Orinda, Pittsburg Center, Oakland International Airport, West Dublin/Pleasanton, Castro Valley, San Bruno, South Hayward, South San Francisco and Warm Springs/South Fremont.

Phase 2 Closures Include Pittsburg/Bay Point and Antioch Stations

The Phase 2 – July 2027 Segment Closure Scenario, Contingent on Phase 1 implementation, would result in a 70% reduction in train hours and 25% reduction in system miles; Segment closures would stop service on most system segments opened after 1976: Yellow line service would end at Concord, shuttering the Pittsburg/Bay Point and Antioch Stations; Orange line service would end at Bay Fair,; Blue line service would be discontinued shuttering the West Dublin/Pleasanton Station; Most stations south of Daly City would be closed except for direct service to SFO would continue for revenue retention; Service continues to Milpitas and Berryessa due to terms of BART/VTA agreements.

Based on Proposed Transit Tax Measure Failing

The plan is based on the assumption a sales tax increase measure proposed for the November ballot in five Bay Area counties fails. As previously reported, voters would be asked to consider a one-half sales tax increase in Contra Costa, Alameda, San Mateo and Santa Clara counties and a one-cent sales tax increase in San Francisco County. The 14-year regional transportation sales tax would generate approximately $980 million annually with 60 percent dedicated to preserving service on BART, Muni, Caltrain and AC Transit, as well as San Francisco Bay Ferry and smaller transit agencies providing service in the five counties to keep buses, trains and ferries moving, including WestCat, County Connection and Tri Delta Transit. About one-third of the revenue would go to Contra Costa Transportation Authority, Santa Clara VTA, SamTrans and the Alameda County Transportation Commission, with flexibility to use funds for transit capital, operations, or road paving projects on roads with regular bus service.

Also, as previously reported, an effort is underway to gather signatures to place the measure on the ballot. The sales tax increase would be in addition to the half-cent sales tax for BART operations in Contra Costa, Alameda and San Francisco counties in place since the 1960’s.

Motion and Vote Details

Following public comments and discussion among the Board members a vote was taken on the following motion: The Board adopts the attached Resolution “In the Matter of Initially Approving an Alternative Service Plan to Take Effect January 2027 in the Event the Connect Bay Area Measure Fails to Receive Voter Approval at the Statewide General Election on November 3, 2026 and BART is Unable to Secure Other Revenue Sources.”

The motion was made by District 4 Director Robert Raburn, seconded by District 1 Director Matt Rinn, and passed on a vote of 8-1 with the additional support of District 7 Director Victor Flores, District 2 Director Mark Foley, District 3 Director Barnali Gosh, District 8 Director Janice Li, Board Vice President and District 9 Director Edward Wright and Board President and District 5 Director Melissa Hernandez.

District 6 Director Liz Ames was the only member of the Board of Directors to vote “No”.

Rinn represents portions of Central Contra Costa County, all of Lamorinda and most of the San Ramon Valley, Foley represents portions of Central County and all of East County, Gosh represents all of West County and Hernandez represents portions of San Ramon.

Approved Plan Details

The plan includes specific cuts and financial strategies needed to balance both the FY27 (July 1, 2026-June 30, 2027) and FY28 (July 1, 2027-June 30, 2028) budgets. The plan includes service cuts, station closures, fare increases, a 40% reduction in system support services, laying off 1,170 employees and a series of deferrals and one-time resources. The plan does not name specific stations to be closed and makes clear the BART Board will be responsible for all decisions on station closures. You can read the Alternative Service Plan resolution, resolution attachment and presentation to the BART Board.

BART has already made budget cuts across all departments and instituted a series of cost controls, including rightsizing service, labor savings, operational efficiencies, and reducing BART’s office space footprint. At the same time, BART has also worked to increase revenue by installing new fare gates, leasing out BART parking lots, and offering new fare products such as Clipper BayPass. View a detailed list of cost savings implement by BART at bart.gov/fiscalcliff.

Alternative Service Plan Details

To take place in January 2027:

- 3-line service (Yellow, Blue, and Orange line service only, with limited peak service in only the peak commute direction on the Red and Green lines).

- 30-minute frequencies on every line.

- Closing at 9 pm seven days a week.

- This service plan represents a 63% reduction in train hours.

- 30% fare and parking fee increases (the estimated average fare would increase from $4.98 to $6.38).

- Target approximately $30M in savings over 6 months from non-service budget reductions to fleet and non-fleet maintenance, police, cleaning, and administrative support functions.

- Continue deferrals of priority capital allocations and retiree medical contributions.

- Balance remainder of FY27 with one-time resources and financial deferrals.

Following the January 2027 cuts, staff will continuously assess ridership and revenue impacts and the performance of all District functions to determine if further reductions can be safely and legally implemented.

To take place in July 2027 if feasibly safe:

- Target over $175M in annual cost reductions through a cumulative 70% reduction in service hours:

- Maintain 3-line service, 30-minute frequencies on each line, closing at 9pm.

- Close up to 15 stations and/or up to 25% of system track miles.

- The BART Board will be responsible for all decisions on station or line segment closures.

- Increase fares and parking fees up to a cumulative 50%. The estimated average fare would increase to $7.26.

- Target annual operating expense savings of more than a cumulative $130M from non-service budget reductions to fleet and non-fleet maintenance, police, cleaning, and administrative support functions.

- Continue to defer retiree health contributions; defer most remaining capital allocations.

Contingency:

- If at any point it is determined BART can’t safely or legally operate with available resources, stop passenger service.

- Use existing District tax revenues to secure system assets.

- Work to determine system’s future.

Use of the State Loan

BART can’t use state loan money to avoid station closures and service cuts if no new revenue becomes available because without new revenue, there is no way to pay the loan back. The state loan primarily helps with cash flow if a November 2026 transit funding measure is successful. It is a bridge loan that gives BART reassurances money will be available to continue to deliver the best service possible until the sales tax dollars from the successful ballot measure become available for BART’s use. This is projected to happen in July 2027 but could take longer. If a funding measure succeeds, BART will use $97M in loan funds to help balance the FY27 budget.

Allen D. Payton contributed to this report.

Read More

Co-founded by NFL running back Najee Harris and his mother, Tianna Hicks, Da Bigger Picture Foundation is a reflection of family, perseverance and giving back. What started as a vision between mother and son has grown into a mission focused on service, youth empowerment and creating real impact where it’s needed most.

Co-founded by NFL running back Najee Harris and his mother, Tianna Hicks, Da Bigger Picture Foundation is a reflection of family, perseverance and giving back. What started as a vision between mother and son has grown into a mission focused on service, youth empowerment and creating real impact where it’s needed most.

Donations fuel every foundation program — from Get Fitted to youth camps, fun events like the Bay Rideout and community drives.

Da Bigger Picture Foundation – Where Confidence Meets Opportunity! Creating access and opportunity for youth through community programs, school partnerships and events that build confidence. For more information or to donate visit https://dabiggerpicture.com

Read More