For $2 billion in maintenance, preservation and operation of Bay Area’s seven state-owned bridges.

Contra Costa’s representatives voted in favor of 50-cent annual increases beginning Jan. 1, 2026.

By Allen D. Payton

After extending the period for public input, on Wednesday, Dec. 18, 2024, the Bay Area Toll Authority (BATA) Board of Directors voted 15-0-1 to approve toll increases and other toll policy changes for the Bay Area’s seven state-owned bridges beginning Jan. 1, 2026. Tolls will increase to as much as $11.50 by 2030.

According to BATA spokesman John Goodwin, the vote passed “by all 16 members present save one abstention from a brand-new commissioner, Alameda Mayor Marilyn Ezzy-Ashcraft, who represents the cities of Alameda County.”

The board consists of 21 members, with 18 voting members, he shared. Pleasant Hill Mayor Sue Noack, who represents the cities of Contra Costa, and Contra Costa District 5 Supervisor Federal Glover, who represents the County, both voted in favor of the toll increases.

A phased toll increase starting in 2026 is proposed to fund the Toll Bridge Capital Improvement Plan, which includes almost $2 billion of investment which will be used exclusively for the maintenance, preservation and operation of the San Francisco-Oakland Bay Bridge and the Antioch, Benicia-Martinez, Richmond-San Rafael, Carquinez, Dumbarton and San Mateo-Hayward bridges.

The Bay Area’s seven state-owned toll bridges are structurally sound and in good repair. State law requires BATA — working in partnership with Caltrans — to keep them that way.

The toll increases are separate from the $3 increase approved by Bay Area voters in 2018 through Regional Measure 3 to finance a comprehensive suite of highway and transit improvements around the region. The first of the three $1 Regional Measure 3 increases went into effect in 2019, followed by another in 2022. The last of the RM 3 toll hikes will go into effect Jan. 1, 2025, bringing the toll for regular two-axle cars and trucks to $8.

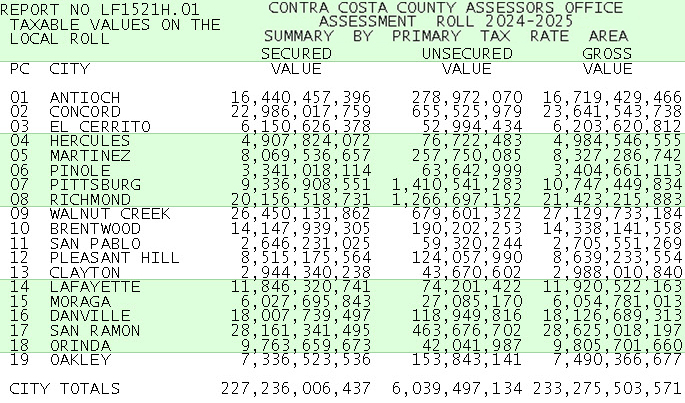

Summary of the 2026 Toll Increase

Toll rates include the last voter-approved Regional Measure 3 (RM 3) toll increase that goes into effect January 1, 2025.

To encourage electronic toll payment with FasTrak® tags, tolls and help recoup the increased costs of collecting tolls via pre-registered license plate accounts or invoices, on Jan. 1, 2027 will also rise by 25 cents for customers who pay with a pre-registered license plate account and on January 1, 2027 will rise by $1 for tolls paid by invoice.

Toll Increase: Two-Axle Vehicle Toll

The toll rate update includes an increase of 50 cents a year from 2026 through 2030 for two-axle vehicles. This phased-in approach is similar to the Golden Gate Bridge’s recent multi-year update to its toll schedule.

*HOV rate is 50% of two-axle FasTrak rate.

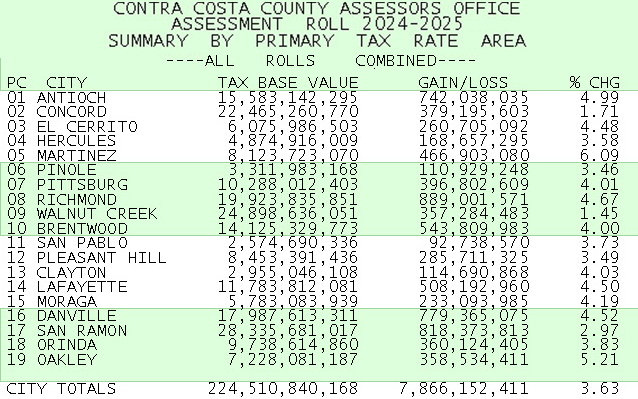

Toll Increase: Three-Axle or More Vehicle Toll

Tolls for multi-axle vehicles also will rise by 50 cents per axle per year from 2026 through 2030.

Multi-axle differential pricing:

- Invoices: +$1.00 per transaction starting January 1, 2027

- License plate account: + $0.25 per transaction starting January 1, 2027

A Precedent for Tiered Pricing

The Golden Gate Bridge, Highway and Transportation District has used a tiered pricing schedule at the Golden Gate Bridge since 2014.

Golden Gate Bridge tolls by July 2028 will range from $11.25 for FasTrak to $11.50 for license plate accounts to $12.25 for invoice customers.

Summary of the Changes to High-Occupancy Vehicle (HOV) Policies

BATA is also making changes to HOV policies. To provide regional consistency and to support the future deployment of open-road tolling at the state-owned bridges, the changes will establish a uniform three-person occupancy requirement for the discounted toll during weekday commute periods at all seven bridges. It will also allow vehicles with two occupants to use the carpool lanes on the approaches to all bridges except the San Francisco-Oakland Bay Bridge. These two-occupant vehicles will not receive the discounted toll but will be able to use the carpool lanes to save time traveling through the toll plazas.

BATA’s existing toll schedule allows vehicles with three or more occupants (HOV 3+) a discounted toll (half-price), with a two-person (HOV 2+) occupancy requirement for the discounted tolls at the Dumbarton and San Mateo-Hayward bridges. To provide regional consistency and to support the future deployment of open-road tolling at the state-owned bridges, the new policy will establish a uniform three-person occupancy requirement for the discounted toll during weekday commute periods at all seven bridges. The discounted toll rate is available weekdays from 5 to 10 a.m. and from 3 to 7 p.m.

The policy changes will also allow vehicles with two occupants to use the carpool lanes on the approaches to the Antioch, Benicia-Martinez, Carquinez, Dumbarton, Richmond-San Rafael and San Mateo-Hayward bridges. These two-occupant vehicles will not receive the discounted toll but will be able to use the carpool lanes to save time traveling through the toll plazas. There will be no change at the San Francisco-Oakland Bay Bridge, where volumes of vehicles with three or more occupants are much higher than those at other bridges. Use of the carpool lanes on approaches to the Bay Bridge will still require a minimum of three occupants.

In addition to establishing region-wide consistency for the carpool toll discount, the policy changes are designed to:

- Improve safety on the toll bridge approaches by minimizing “weaving” between lanes.

- Optimize lane configurations as now-obsolete toll booths are removed as part of the bridges’ transition to open-road tolling.

- Increase person-throughput by prioritizing access for buses and carpools.

Read more about the BATA toll increases, here.

See BATA Board meeting agenda items 24-1571 through 24-1575. Watch meeting video.