The City of Lafayette has sought opportunities to combine relatively small projects with the City of Orinda, Town of Moraga, and Contra Costa County to take on larger, less expensive projects for each public agency.

This ultimately means more efficient use of taxpayer dollars, improved infrastructure, and a better overall quality of life for residents in each participating community.

Through these joint efforts, the cities can use economies of scale for construction projects and save money because the contractor’s overhead becomes a smaller percentage of the overall project costs.

“This can take the form of lower unit prices for asphalt pavement and surface seal materials or an increase in the number of bidders, thus a more competitive bidding environment,” explained Mike Moran, the Director of Engineering and Public Works for the City of Lafayette, CA.

Lafayette has collaborated with the City of Orinda, Town of Moraga, and Contra Costa County to combine smaller projects into one large project that is more cost-effective for each public agency. Two recent examples of such projects include the following:

- 2019 Surface Seal Project with the town of Moraga; Lafayette spent $391,000, and Moraga spent $1.5 million.

- 2022 Surface Seal Project with the town of Moraga and Contra Costa County; Lafayette spent $2 million, Moraga spent $418,000, and the County spent $60,000.

“By collaborating with our neighboring cities and the County, we spent less money and fostered stronger working relationships with our neighbors,” says Lafayette Engineering Services Manager Matt Luttropp.

According to City Manager Niroop Srivatsa, the City continuously seeks ways to save money and secure more. “Additional funding is necessary to maintain the City’s infrastructure, with a particular focus on road maintenance needs,” Srivatsa concludes.

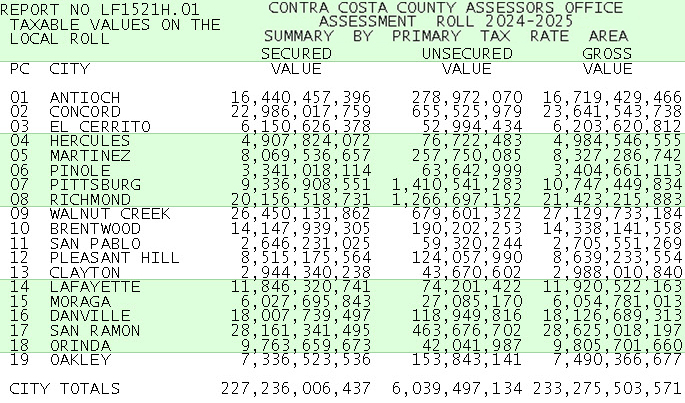

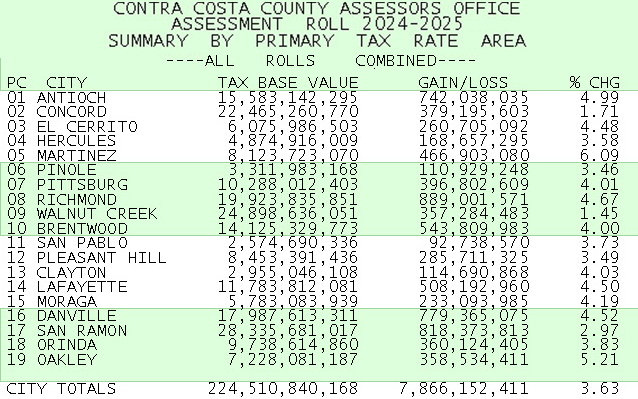

Lafayette is a charming small community located in Contra Costa County, 30 miles from The City of Oakland. It’s known for its beautiful green hills, excellent schools, and miles of hiking trails, making it an attractive place to live. The City has a population of more than 25,000 highly educated residents, with 75.2% of them holding a bachelor’s degree or higher. Additionally, 73.6% of the homes in Lafayette are owner-occupied. The median home value is $1,914,700, while the median household income is $219,250. The total area of the city is 15.22 square miles.

For more information, email LafayetteListens@LoveLafayette.org, call (925) 299-3206 , or visit www.LoveLafayette.org.