Can you please write a letter to the Board of Supervisors by Nov. 2nd?

By Arts and Culture Commission of Contra Costa County

Measure X is Contra Costa’s new countywide half-cent sales tax. The Measure X Community Advisory Board was formed to identify unmet community needs and recommend spending priorities to the Board of Supervisors. The Measure X Community Advisory Board recommended funding for the Arts and Culture Commission to the Board of Supervisors. At the Nov. 2nd meeting, Supervisors will be making final recommendations.

Measure X is Contra Costa’s new countywide half-cent sales tax. The Measure X Community Advisory Board was formed to identify unmet community needs and recommend spending priorities to the Board of Supervisors. The Measure X Community Advisory Board recommended funding for the Arts and Culture Commission to the Board of Supervisors. At the Nov. 2nd meeting, Supervisors will be making final recommendations.

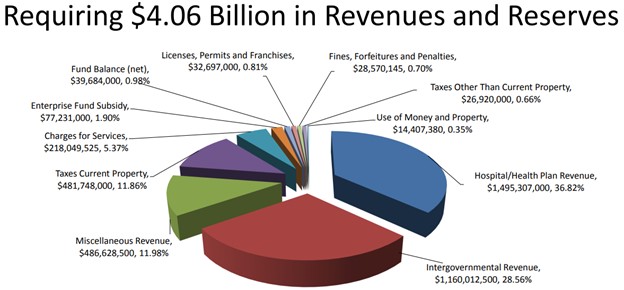

The current Contra Costa County $31,000 grant match budget is only a $.06 per person investment: Napa $3.55, Solano $2.19, Santa Clara $0.92, and Alameda County $0.54.

Please support signature programs that provide services to Contra Costa County: Arts and Culture Prospectus of Contra Costa County, ABOUTFACE, Poetry Out Loud, Youth Advisor, Jump StArts California Arts Council grant, Impact Projects California Arts Council grant, Art Passages, and more!

Transformational ideas include:

- District Public Art Program: Let’s build Contra Costa County’s first public art program following best practices of other Bay Counties.

- Youth Advisor in each District: We want to expand equity and opportunity to every District!

- Arts Connection: We want to connect artists and art organizations for quarterly meetings for advocacy, opportunities, and data collection.

- Community Art Fund: Support up to 5 community art projects a year!

- AIRS (Artist-in-Residency in the School) pilot program: Place teaching artists in CCC schools to work with students to create an art project.

- Build Structures: Community creates policy for new and signature programs based on equity!

Ask: $625,000 at $.54 per resident!

Supervisors:

- John Gioia, District 1 (Richmond to Pinole): john_gioia@bos.cccounty.us

- Candace Andersen, District 2 (Lamorinda, Danville, San Ramon): supervisorandersen@bos.cccounty.us

- Diane Burgis, District 3 (most of Antioch, Oakley, Brentwood & far east county): supervisor_burgis@bos.cccounty.us

- Karen Mitchoff, District 4 (Pleasant Hill, Concord, Walnut Creek, Clayton): SupervisorMitchoff@bos.cccounty.us

- Federal Glover, District 5 (Hercules, Martinez, Pittsburg & along Delta in Antioch): district5@bos.cccounty.us

District locator: https://www.contracosta.ca.gov/5715/Supervisor-Who-Represents-Me

Please send email by Nov. 2nd!

Sample email: The arts are important to me and to my community. Please increase funding for the arts in Contra Costa County from $31,000 to $625,000 annually. This will help the Arts and Culture Commission demonstrate support for the arts to be competitive for national and state grants. This will support signature programs that directly impact all communities including our youth to Veterans. It will help provide public art programs in each district, a Community Art Fund, a youth advisor in each district, an Artist-In-Residency in the School pilot program, the Arts Connection and Build Structures initiative and other great programs. It will help our County stabilize arts funding and be able to plan equitably for the future. Thank you.

Let’s build an arts foundation for Contra Costa County!