Due to purchase and use of hybrid and electric vehicles

Receive up to $400 in gift cards for 6-month Pilot program beginning Aug. 2024

By Allen D. Payton

Caltrans has launched a test on the proposed per mile Road Charge to possibly replace the state’s current gas tax and invites the state’s drivers to participate. The Pilot program will last six months and participants can earn up to $400 in gift cards.

With the passage of Senate Bill 1077 introduced in 2014 by then-State Senator (now-Congressman) Mark DeSaulnier, California began investigating a long-term, sustainable transportation funding mechanism as a potential replacement to the gas tax, known as a “road charge” due to the advent of hybrid and electric vehicles. As of 2022, state officials estimate that there were about 1.1 million electric cars and 1.3 million hybrids on California roads.

Taking direction from the Legislature, California completed the largest road charge research effort to date piloting more than 5,000 vehicles that reported in excess of 37 million miles over a nine-month duration. According to the program’s report, the statistics only serve to reinforce Californians’ desire for mobility, a safe and reliable transportation system, and an improved overall quality of life. Below please find the California State Transportation Agency’s release of the California Road Charge Pilot Program final report.

History of Transportation Funding

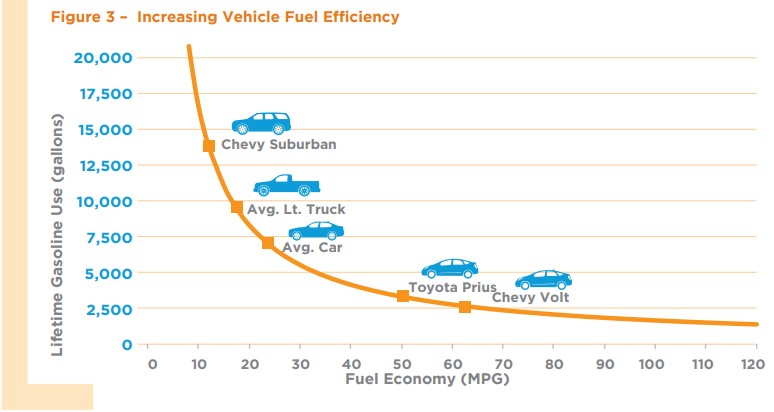

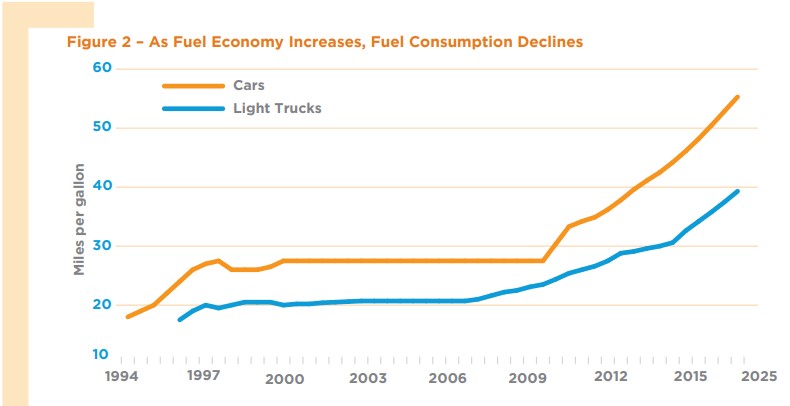

According to the Road Charge Pilot Program Summary Report, Nearly all of the 350 billion miles driven each year on California’s highways and roads are powered by gasoline or diesel fueled vehicles. Historically, the taxes on those fuels provided the majority of the revenue required to maintain and operate our transportation network. As future consumption of gasoline and diesel fuel declines, due to increased fleet efficiency, California will be challenged to sustain its $2.5 trillion economy. Continuing to depend on a consumption-based transportation model, while at the same time adopting policies to increase vehicle fuel efficiency and promote the reduction of vehicle miles traveled, puts into question the long-term viability of the gas tax as a sustainable revenue model.

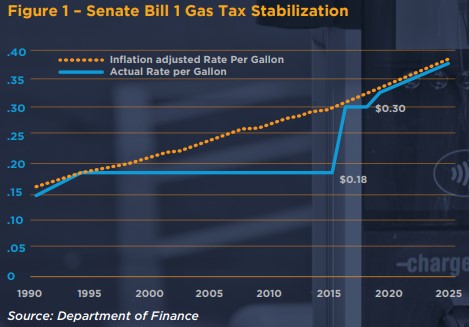

Historically, transportation funding has been impacted by two main factors: inflation and vehicle fuel efficiency. Until this year, with the passage of the Road Repair and Accountability Act of 2017 (Senate Bill 1), the state gas tax had not been adjusted for inflation since 1994, which significantly reduced its purchasing power. Senate Bill 1 adjusted fuel rates for past inflation and includes future inflation adjustments: hence, solving the inflation issue and delaying the expected transportation funding shortage by a decade or more. However, the impact of improving vehicle fuel efficiency remains an issue, especially as new vehicles sold in the coming decades are expected to be much more fuel efficient.

The report claims, “Without Senate Bill 1’s inflation adjustments, the transportation funding shortfall would be quickly approaching. The new Senate Bill 1 revenues, as illustrated in Figure 1, stabilize the state’s short-term transportation infrastructure funding needs and provides time to explore alternatives to continued reliance on fuel taxes.”

How Transportation Funding Works

Currently, it costs approximately $8.5 billion annually to maintain California’s roads.

- Approximately 80% of highway and road repairs are funded by a tax on gasoline charged at the pump when you buy gas. The more gas you buy, the more you pay in gas taxes and the more you contribute to highway and road repairs.

- On average, Californians pay about $300 a year in state gas taxes.

- Various state fees also support transportation. Trucks pay weight fees and zero-emission vehicle owners pay $118 each year, and all vehicle owners pay a transportation improvement fee.

- Some counties also charge a local sales tax to further invest in road and transit needs or have tolls on bridges or certain highways.

- The public may also pass state bonds to invest in additional transportation needs.

California relies on gas tax and other fuel tax revenues to fund its roadway maintenance and repairs. But as cars get more fuel efficient or use other energy sources, such as electricity and hydrogen, the gas tax will no longer fund the infrastructure California needs. California is researching a potential gas tax replacement that’s both sustainable and equitable: road charge. A road charge is a “user pays” system where all drivers pay to maintain the roads based on how much they drive, rather than how much gas they purchase. Under a road charge, all drivers share roadway maintenance and repair costs based on what they actually use. (https://dot.ca.gov/programs/road-charge)

- California could replace the gas tax with a mileage-based user fee charged to drivers who use the roads. The more you drive, the more you pay for highway and road repairs. The less you drive, the less you pay.

- Everyone would pay their fair share for road repairs based on how much they drive, not the kind of car they own.

- California is working to develop a road charge program that is fair, transparent, and sustainable so that it meets our road maintenance needs now and in the future.

Most States Pursuing Vehicle Miles Traveled Taxes

According to the Tax Foundation, most states are taking steps toward a vehicle miles traveled (VMT) tax. “Oregon was the first state to begin research into VMT taxes in 2001 and was the first to implement a program in 2015. Four states now have active programs for passenger vehicles and four other states have active programs targeting heavy commercial vehicles (Oregon has both), with pilot programs carried out in 16 states. Only Hawaii has a mandatory program, which requires EVs to participate by 2028 and all light vehicles by 2033.”

Calculator Compares Road Charge vs. State Fuel Tax Costs

The “Road Charge” vs. gas tax calculator for a sample cost comparison of paying the current gas tax of $0.579 per gallon as of July 1, 2023, versus a per mile road charge offers options of $0.02, $0.03 and $0.04. At two cents per mile the Total Monthly Road Charge would be less than the Total Monthly State Fuel Tax for a gas-powered vehicle. But at three cents per mile, the monthly cost of the Road Charge would be greater than the current fuel tax.

For a 2024 Chevrolet Equinox EV driven an average of 1,000 miles per month the Road Charge annual costs would be $240 at two cents, $360 at three cents and $480 at four cents per mile versus the current $118 annual fee. The calculator “Does not include any federal or local taxes” and shows, “Rates are hypothetical and would be set by the California Legislature.”

Participate in 2024 Road Charge Collection Pilot

The Road Charge policy idea is still being explored and developed. The public’s input and ideas can help inform what the best way might be to implement a program in California. Drivers are asked to participate in the 2024 Road Charge Collection Pilot and earn up to $400!

- Receive up to $400* in gift cards

- Participate for 6 months; Aug 2024 – Jan 2025

- Pay road charges each month

- Gas tax refunded end of pilot

- Take 2 surveys to tell us about your pilot experience

*Complete all required activities throughout the Pilot and earn up to $400: $100 distributed in September 2024 and up to $300 will be distributed in February 2025.

To learn more and participate in the pilot program visit https://caroadcharge.com/engage/contact-us-pilot/, call (916) 619-6283 toll-free or email info@caroadcharge.com.

Leave a Reply