Ralph Rechnitiz will host a traditional Passover Seder again this year with his Palestinian ministry partner Saed Awwad on Good Friday, March 29 at 5:00 p.m. at Campos Family Vineyards, 3501 Byer Road in Byron.

All are invited to join in for an evening filled with delicious food, meaningful rituals, and joyful celebration! For more information click, here.

Read MoreMotivated by serving others, businessman and former Mayor Thom Bogue wants to bring common sense back to Sacramento

By Allen D. Payton

Thom Bogue is an unassuming, common man, a small business owner, Dixon City Councilman and former mayor. But the Sacramento, California native had a very interesting, unusual and uncommon upbringing, and overcame a major challenge and tragedy as a teenager that unless he shared of it, you would never know.

Having grown up in the People’s Temple cult, and meeting and knowing it’s late, nefarious, infamous leader, Jim Jones, Bogue literally didn’t drink the Kool-Aid, unlike one of his older sisters who remained behind and died along with 900 others. Instead, he chose to escape into the jungle with his other siblings, getting shot in the leg in the process, while leaving their parents behind at the airfield runway.

They eventually met up with their parents and all, but the one sister, were able to make it to safety and return to the United States, surviving the horrors of Jonestown. Yet, in spite of the terrifying experience, Bogue did learn one good thing and that was to care about everyone else in the community. He believes it’s one of the reasons he felt led to run for and serve in public office, first locally and now for the State Senate in District 3.

Married and a father to nine children, with his father living with them, the councilman has done what he can to meet the needs of his blended family, his customers and the community. Now, Bogue wants to take his life, business and local government experience a short drive, up Interstate 80, return to Sacramento and bring some common sense back to the state’s government.

He believes in working together to solve our collective challenges such as crime, homelessness, immigration, high taxes, the budget deficit, water insecurity, over-regulation, the undermining of parental rights, unemployment and the economy, as well as the conversion to green energy.

Bogue Places First in Primary Election

With the March 5th primary election results still unofficial, but according to the California Secretary of State’s website (as of March 26th) only 1,021 ballots remain to be counted in the five counties the Senate district includes, Bogue took first place out of five candidates. He had 61,811 votes or 27.8% of the vote and will face second place finisher and former West Sacramento Mayor Christopher Cabaldon, who had 59,082 votes or 26.6%, in the November 5th general election.

In a March 6th post on his campaign Facebook page, Bogue wrote, “I am very touched by those voting for me and I will do my best to not disappoint you as we go forward towards the General election in November. I told you after the Primary it would be time to start putting legislative bills together to be submitted within the 1st 120 days if elected in the General, being a person who means what I say I begin that process today and will publish for your viewing as completed. If there is more you want to have submitted let me know, as I work for you.”

About State Senate District 3

The District includes all of Solano County, Napa County, and Solano County and portions of eastern Sonoma County, southwestern Sacramento County and far eastern Contra Costa County, including the cities of Brentwood and Oakley, and the communities of Discovery Bay, Byron, Bethel Island and Knightsen.

The seat is open as incumbent State Senator Bill Dodd is termed out and could only serve two of the four-year term according to a last-minute decision by the Secretary of State. But Dodd disagreed saying he’s only eligible for two more years in the State Assembly but chose to not run for either.

Bogue believes in placing people before politics and says he will work to bring people “together to bring about real change and restore California to its rightful place as a prosperous and thriving state.”

“I am committed to bringing my experiences and dedication to serve individuals and our communities to the state level, regardless of party affiliation. It’s very simple, I represent everyone in being a people’s person,” he added.

Learn more about Bogue’s background and plans to address the issues as District 3’s next State Senator at www.thombogue4statesenate.com.

Read MoreWebinar April 17

By Lasherica Thornton, EdSource.org

Over 3.6 million school-aged children across the state qualify for at least $500 in savings with the California Kids Investment and Development Savings program (CalKIDS), a state initiative to help children from low income families save money for college or career.

Just 8.3% of eligible students, or 300,000, have claimed their accounts as many families are unaware of CalKIDS or face challenges accessing the accounts once aware. The money is automatically deposited into the savings account under a student’s name, but families must claim the accounts by registering online.

Here is information you should know about the state-funded accounts:

What is CalKIDS?

The CalKIDS program was created to help students, especially those from underserved communities, gain access to higher education. It helps families save for post high school training by opening a savings account and depositing between $500 and $1,500 for eligible low-income students in the public school system. Gov. Gavin Newsom, who launched the program in August 2022, invested about $1.9 billion in the accounts.

Who qualifies?

Low-income students and all newborns qualify.

According to program details, low-income public school students are awarded $500 if they:

- Were in grades 1-12 during the 2021-22 school year

- Were enrolled in first grade during the 2022-23 school year, or

- Will be in first grade in subsequent school years.

An additional $500 is deposited for students identified as foster youth and another $500 for students classified as homeless.

For newborns,

- Children born in California after June 2023, regardless of their parents’ income, are granted $100.

- Those born in the state between July 1, 2022, and June 30, 2023, were awarded $25 before the seed deposit increased to $100.

- Newborns get an additional $25 when they claim the account and an additional $50 if parents link the CalKIDS account to a new or existing ScholarShare 529 college savings account.

The California Department of Education determines eligibility based on students identified as low income under the state’s Local Control Funding Formula or English language learners. The California Department of Public Health provides information on newborns.

How can students use the money?

The money can be used at eligible higher education institutions across the country, including community colleges, universities, vocational or technical schools and professional schools, according to CalKIDS.

The funds can be used for: tuition and fees, books and supplies, on or off-campus room and board as well as computer or other required equipment, according to the CalKIDS program guide.

Click here to search for schools that qualify as an eligible higher ed institution.

Does the CalKIDS account have restrictions similar to those for a 529 savings account?

CalKIDS accounts are a part of the ScholarShare 529 program — California’s official tax-advantaged college savings plan — and administered by the state’s ScholarShare Investment Board.

Transportation and travel costs are usually not considered qualified expenses for 529 savings accounts.

According to the guide for CalKIDS, if a student has no account balance with their higher education institution — which receives the CalKIDS distribution check — the institution can pay the funds directly to the student.

Does the money in the CalKIDS accounts earn interest?

The deposits grow over time because CalKIDS accounts are interest-bearing.

How aggressive that growth is depends on the age of the student, said Joe DeAnda, communications director with the California State Treasurer’s Office, which oversees the CalKIDS program.

“If it’s a newborn, (the seed deposits are) invested in a fairly aggressive portfolio that assumes 18 years of investing time,” DeAnda said. “If they are school-aged, they’re invested in a more conservative portfolio that assumes a shorter investing timeline and is a more secure portfolio.”

Even among students, the younger a child is, the more aggressive the savings portfolio will be. The investment provides “opportunity to grow savings while the child is younger and better safeguard savings against market fluctuations when the child nears college age,” according to the CalKIDS program guide.

Specifically, accounts for newborns, each new class of first graders and students in grades 1-5 during the 2021-22 school year are invested in a portfolio that corresponds to the year that they’re expected to enter a program after high school, or at age 18. The portfolio will become more conservative as the child gets older.

For students in grades 6-12 during the 2021-22 school year, the accounts are invested with a guaranteed, or fixed, rate of return on the investment.

Can I add to the account?

No, you cannot add money to the CalKIDS account. Parents or guardians can open a ScholarShare 529 account, which can be linked to the CalKIDS account so they can view the accounts in one place.

In fact, CalKIDS encourages families to open a ScholarShare 529 college savings account, which is a way for families to save even more money for their children, DeAnda said.

What if my student already graduated? What happens to unclaimed money?

The accounts remain active under a student’s name until the student turns 26 years old. Up until that age, students can claim the money.

If the account is not claimed by age 26, the account closes, and the money is reallocated to others in the CalKIDS program, DeAnda said.

What if I’m not sure if my child is considered low income?

CalKIDS has sent notification letters of program enrollment to over 3.3 million eligible students and nearly 270,000 students in last school year’s class of first graders.

Without the letters, to check student eligibility, families must enter students’ Statewide Student Identifier (SSID), a 10-digit number that appears on student transcripts or report cards, according to the CalKIDS website.

The California Department of Education provides CalKIDS with data on first graders in the late spring or early summer and asks parents to wait until then before checking for their child’s eligibility.

How do I access that SSID number to check eligibility or to register the account?

The SSID may be found on the parent’s or student’s school portal, transcript or report card.

The CalKIDS website instructs families to contact their child’s school or school district if they’re unsure of how or unable to locate the number.

How do I access or ‘claim’ the account?

The notification letter that CalKIDS sends families contains a unique CalKIDS Code that can be used to register the accounts. Even without the code, families can register the accounts.

To claim the student account:

- Visit the CalKIDS registration page to claim the account. Click here to register.

- Enter the county where the student was enrolled (for a student in grades 1-12 in the 2021-22 school year; for a first grader, where the student was enrolled in 2022-23 or subsequent years)

- Enter student’s date of birth

- Enter the SSID or CalKIDS Code from the notification letter

- Click Register

- Set up the account, either as the child or as the parent/guardian, with a username and password

To claim the newborn account, which should be available about 90 days after birth:

- Visit the CalKIDS registration page to claim the account.

- Enter the county where the child was born

- Enter child’s date of birth

- Enter the Local Registration Number on the child’s birth certificate or CalKIDS Code from the notification letter

- Click Register

- Set up the account, either as the child or as the parent/guardian, with a username and password

I still need help. How do I get additional support?

Contact CalKIDS at (888) 445-2377 or https://calkids.org/contact-us/

The CalKIDS team is also hosting an April 17 webinar to outline the program, eligibility, account registration, fund distribution and benefits. To sign up for the webinar, click here.

How does my high school graduate make a withdrawal to use the money?

According to the CalKIDS program guide, to request a distribution, log into the claimed CalKIDS account and request a distribution, which doesn’t have to be for the entire amount. The funds are tax-free for the qualified expenses of tuition, books, fees, computers and equipment.

The student must be at least 17 years old and enrolled at an eligible institution.

The CalKIDS money, which will be sent to the institution, is considered a scholarship from the state of California.

Read More

Ballet Folklórico Netzahualcoyotl dancers will perform accompanied by Mariachi Monumental. Photo from Contra Costa County District 5 Chief of Staff David Fraser.

Únase a nosotros el martes 26 de marzo de 2024 para la 30ª Celebración Conmemorativa Anual de César E. Chávez.

During Contra Costa County Board of Supervisors meeting

This year’s theme: Perseverance & Progress – Perseverancia y Progreso.

By Kristi Jourdan, PIO, Contra Costa County

(Martinez, CA) – The Contra Costa County Board of Supervisors will honor César E. Chávez in a celebration recognizing his commitment to social justice and respect for human dignity. The 30th Annual César E. Chávez Commemorative Celebration will be at 11 a.m., Tuesday, March 26, in Board Chambers at 1025 Escobar Street in Martinez.

“We honor César E. Chávez and recognize his legacy of fighting injustice and improving the lives of farmworkers, their families, and so many others. We are inspired to once again commit ourselves to service to others,” said Board Chair Supervisor Federal Glover. “We also recognize our 2024 Youth Hall of Fame awardees whose commitment to service and community are to be celebrated and are the force moving forward Cesar Chavez’s legacy.”

The theme for this year’s celebration is Perseverance & Progress – Perseverancia y Progreso. The festival will feature keynote speaker Contra Costa Community College District Trustee Fernando Sandoval who was raised in the City of Pittsburg where he also attended school. Fernando joined the U.S. Navy like Cesar Chavez. Fernando played an instrumental role aboard the USS Enterprise during the Vietnam War, where his expertise in data systems previewed the vital importance of STEM education, a field he continues to support passionately. Fernando’s book, “From Tortilla Chips to Computer Chips,” is a testament to his life’s work and an educational and motivational touchstone for students and educators alike. Fernando continues to embody the value of education, community, and family like Cesar Chavez.

The event will include presentation of the 2024 Youth Hall of Fame Awards to students who make outstanding community contributions, live performances by Mariachi Monumental and Ballet Folklórico Netzahualcoyotl, spoken word performance by Jose Cordon, and celebratory remarks from members of the Board of Supervisors.

County’s 2024 Youth Hall of Fame Awards winners:

High School Awardees:

Volunteerism: Mariella Cajina, Carondelet High School

Teamwork: Neil Chandran, Monte Vista High School

Perseverance: Aditya Narayan, Dougherty Valley High School

Leadership & Civic Engagement: Morelia Gil-Cubillo, Antioch High School

Good Samaritan: Nitya Varanasi, California High School

Innovation and Empowerment: Alice Zhou, Miramonte High School

Middle School Rising Stars:

Volunteerism Rising Star: Samhita Chikoti, Gale Ranch Middle School

Leadership & Civic Engagement Rising Star: Dhruv Subramanian, Windermere Ranch Middle School

The annual celebration honors the diversity and richness of our community. Community members can also join the event live on Contra Costa Television channels and the County’s website.

To learn more about the César E. Chávez Ceremony, visit www.contracosta.ca.gov/6039 on the Contra Costa County website. The community can also watch the event live online at www.contracosta.ca.gov/6086 or www.contracostatv.org. The celebration will broadcast live on Contra Costa Television channels: Comcast Cable 27, ATT/U-Verse 99, and Astound 32 & 1027.

Read MoreFrom Antioch, Bay Point, Richmond; $150K of items stolen in organized retail theft

Antioch man has history of arrests, as does one other suspect from Hayward

By Tracy Police Department

On Thursday, March 21, 2024, at approximately 2:25 p.m., the Tracy Police Department Communications Center received reports of a robbery in progress at Don Roberto Jewelers located inside the West Valley Mall. During the robbery, eight (8) subjects, wearing face masks, entered the store and used hammers to smash the glass displays, proceeding to take approximately $150,000 in jewelry before fleeing the area.

As the subjects associated with the robbery were seen fleeing the area, witnesses reported observing a stolen white BMW SUV occupied by four (4) of the subjects was involved in a solo crash near the east entrance of the mall near Corral Hollow Road, while the other four (4) subjects were able to get away. As the four subjects involved in the crash fled on foot,

Due to the four subjects involved in the crash fleeing on foot, Stockton Police Department Air Support, the California Highway Patrol, and the San Joaquin County Sheriff’s Office responded to assist in an area search. During their search, the four subjects, identified as Eric James Anderson (21 years old of Antioch, CA), Trevion Williams (21 years old of Bay Point, CA), Jayden Deonte Barnes (19 years old of Richmond) and Jamary Barnes (23 years old of Hayward, CA) were located within the perimeter set by Tracy PD and assisting agencies.

Investigators assigned to the General Investigations Unit (GIU) responded to the scene to continue the investigation.

All four subjects were arrested for PC 490.4 – Organized Retail Theft, PC 182 – Conspiracy to commit a crime, and PC 211 – Robbery by force or fear, and booked into the San Joaquin County Jail.

According to localcrimenews.com, the 6-foot, 7-inch, 140-pound Anderson, who is Black, has been arrested multiple times since June 2021 by Alameda County, Kern County and San Joaquin County Sheriffs’ Departments, Oakland PD and as recently as Feb. 29, 2024, by Fresno PD including for multiple gun crimes, vehicle robbery, burglary, receiving stolen property, vehicle theft and evasion with wanton disregard for safety.

According to localcrimenews.com, the six-foot, four-inch, 160-pound Barnes, who is Black, also has a history of arrests dating back to Sept. 2019 by multiple agencies for crimes including street terrorism, possession of a machine gun, grand theft, gang conspiracy, drug possession and first-degree residential robbery.

At this time, the investigation is ongoing. If you have any information, contact Detective Kenneth Steele at Kenneth.Steele@TracyPD.com or (209) 831-6660, or Detective Lissette Ortiz at Lissette.Ortiz@TracyPD.com or (209) 831-6569. To make an anonymous tip, contact Tracy Crime Stoppers by calling (209) 831-4847 or by texting “TIPTPD” and your message to CRIMES (274637).

Allen D. Payton contributed to this report.

Read More

Guns seized from Hansen’s home in Richmond during his first arrest announced in February. Photos: CA DOJ

Cache of weapons included machine guns, assault rifles, silencers, homemade explosives

CA Attorney General announced first arrest in Feb., but state DOJ didn’t request prosecution and suspect was released, re-arrested March 17

By Ted Asregadoo, PIO, Contra Costa District Attorney’s Office

Martinez, California – The Contra Costa District Attorney’s Office filed a 21-count felony complaint against a Richmond man for possessing a large cache of illegal weapons, high-capacity magazines, and homemade explosives.

68-year-old Lawrence Robert Hansen (born 7/15/55) of Richmond is in custody after he was arrested on an outstanding warrant on March 17th by Richmond Police. Hansen is also listed on the Armed and Prohibited Persons System which tracks individuals who are barred from owning or possessing firearms.

Between 2022-2023, Hansen made several violent firearm-related threats to medical staff at a Walnut Creek clinic while seeking treatment. Staff members reported those threats to Walnut Creek Police on September 18th, 2023. In a separate incident, Hansen was transported to a hospital in Walnut Creek on September 26th, 2023, for a medical issue. During an examination, a staff member saw that Hansen had a handgun (later determined to be loaded) in his waistband area. The weapon was taken from Hansen and police were informed.

Because of the legal prohibition against Hansen possessing firearms, as well as threats made to medical employees, members from the Contra Costa Anti-Violence Support Effort Task Force, California Department of Justice’s (DOJ) Bureau of Firearms, and Contra Costa County Probation Officers searched Hansen’s residence with a court-ordered warrant in Richmond on January 31, 2024. During the search, agents found 11 machine guns, more than 130 handguns, 37 rifles, 60 assault rifles, 7 shotguns, 3,000 large capacity magazines, several grenades (inert), homemade explosives, incendiary ammunition, and around one million rounds of ammunition.

Hansen was arraigned on March 18th in Martinez. He entered a plea of not guilty and is being held without bail in the Martinez Detention Facility. A preliminary hearing is scheduled for March 27th in Department 23 at 8:30 am.

As previously reported, following the Jan. 31 search, California Attorney General Rob Bonta announced on Feb. 15 the arrest of Hansen. Asked why he was out of custody and arrested again on March 17, Asregadoo responded, “Upon receiving a request for prosecution (RFP) from the arresting police agency, a case undergoes review to determine whether to file charges. The RFP should include investigative reports and evidence relevant to the case. In the instance of Lawrence Robert Hansen, the arresting agency, Cal DOJ, did not immediately request prosecution at the time of arrest. Instead, Cal DOJ chose to finalize their investigation before submitting the request for prosecution along with associated reports and evidence to the Contra Costa District Attorney’s Office.”

According to the Contra Costa County Sheriff’s Office, Hansen is a 5-foot, 11-inch, 190-pound Hispanic man.

Case No. 02-24-00234 | The People of the State of California v. Hansen, Lawrence Robert

Allen D. Payton contributed to this report.

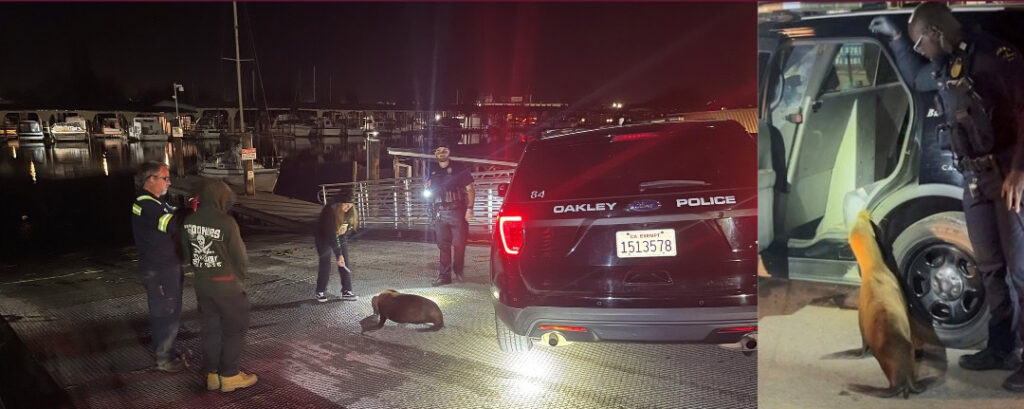

Read More“Sea? We’re not lion when we say OPD is the best police department around! Good night, Oakley!”

By Oakley Police Department

On Sunday, March 17, 2024 – St. Patrick’s Day — at 9:27 PM Oakley Police Officers C. Taylor and M. Jackson were dispatched to the Valero Station at the corner of E. Cypress Road and Knightsen Avenue for a young and wayward sea lion that was in the road and in danger of being hit by a car. Our officers worked with other citizens in corralling the sea lion and SEALing it into a specific area.

Our officers tried staying two steps ahead of the thoroughbred pinniped, but still found it difficult to coax it into the back of a patrol vehicle. The officers found that if one of them sat in the back of the vehicle and kept repeating, “free bass,” it would gain the attention of the seal lion and eventually it hopped right up and into the vehicle.

Our officers called the Marine Mammal Center, but nobody was available to pick up our passenger. With the exception of being a little lost, the sea lion seemed fine, uninjured and able bodied. The sea lion was given a chauffeured ride to a local marina and set free back into the Delta waters.

Read MoreFrom San Pablo, Pleasant Hill; police seek second shooting suspect

By Pleasant Hill Police Department

On Tuesday, March 19th, 2024, the Pleasant Hill Police Department dispatch received reports of a shooting in the area of Twinbridge Circle near Longbrook Way. Witnesses reported hearing multiple gunshots with two victims injured and lying on the ground.

Police and medical personnel responded to the scene. Upon arrival, two adult male victims were found with multiple gunshot wounds. Both victims were transported to the John Muir Medical Center in Walnut Creek. One victim was pronounced deceased, the second was treated for life-threatening injuries.

On Wednesday, March 20, 2024, the second person shot during Tuesday’s incident on Twinbridge Circle has died in the hospital as a result of his injuries.

The identities of the two decedents are Pleasant Hill resident Peter Popovich, 63, and San Pablo resident Trevon Davis, 21. Pleasant Hill Police investigators have confirmed Popovich and Davis did not know one another.

This case is now being investigated as an attempted robbery resulting in homicide.

Investigators determined the victim, Peter Popovich, worked in the legal cannabis industry. The company he worked for sells packaging materials for the legal distribution and sales of cannabis. Earlier in the day, Popovich had been working in his capacity as a delivery driver, delivering packaging materials to Bay Area cannabis distributors.

At this time, the facts of this investigation indicate that Popovich was targeted for robbery by Trevon Davis and at least one other suspect while he was standing near his van parked on Twinbridge Circle. Both the suspects and Popovich were armed, leading to an exchange of gunfire. During this altercation, both Popovich and Davis were shot multiple times. At least one other suspect immediately fled the scene and, at this time, has not been identified. No arrest has been made.

Pleasant Hill Police investigators determined Popovich used his own firearm during the incident. Popovich’s firearm was recovered at the scene. Popovich possessed a valid permit to carry a concealed weapon which was issued by the Contra Costa County Sheriff’s Office.

During the initial investigation, witnesses told investigators they heard the shooting and then saw a vehicle fleeing the scene. Currently, there is no information to share regarding the suspect vehicle.

This incident remains an active investigation. Any person with information related to this crime is encouraged to contact the Pleasant Hill Police Investigations Bureau at (925) 288-4630.

Read More

Ferrari like the one purchased by Harry Corl, III. Photo: USDOJ The former Santa Clara location of Nu-Metal Finishing, Inc. Source: finishingandcoating.com

Harry Corl, III also embezzled substantial company funds from employee stock ownership plan for luxury cars, Tiffany & Co. jewelry; required to pay $253,625.50 in restitution

By U.S. Attorney Northern District of California

SAN JOSE –was sentenced Tuesday, March 19, 2024, to 30 months in prison and ordered to pay $253,625.50 in restitution to over 30 victim employees and shareholders, announced United States Attorney Ismail J. Ramsey and Klaus Placke, Regional Director of the U.S. Department of Labor’s Employee Benefits Security Administration, San Francisco Regional Office.

Corl, now of Pittsburg, California, was indicted on several wire fraud and money laundering counts by a federal grand jury on November 29, 2018. On September 25, 2023, he pleaded guilty to conspiracy to commit wire fraud in violation of 18 U.S.C. § 1349.

According to court filings, from 2008 to 2014, Corl and his estranged wife and co-defendant were executive officers for Nu-Metal Finishing, Inc. They also served as trustees of the company’s Employee Stock Ownership Plan and Trust, or ESOP, which provided retirement benefits and savings to the company’s employees by purchasing and investing company stock for their collective benefit. As trustees, the Corls had a fiduciary duty to competently manage the ESOP’s cash, stock, and assets and act in the best interests of the employee-shareholders. They failed to do so.

As set forth in the government’s sentencing memorandum, from 2011 to 2014, Corl used Nu-Metal’s corporate accounts to pay for numerous personal expenses wholly unrelated to the business of a metal finishing company. For example, Corl used corporate funds to purchase extravagant jewelry from Tiffany & Co. and made lease payments on a Ferrari 599 GTB coupe, listing Nu-Metal Finishing as a lessee. Corl also used corporate funds to lease a Bentley and to purchase outright a Mercedes S63 sedan. The Corls flaunted their luxury car collection on social media.

Furthermore, in May 2014, the Corls arranged a fraudulent sale of Nu-Metal. In all formal written agreements and conversations with all parties involved, the Corls represented themselves as the sole owners of the company, falsely stating that the ESOP had been terminated and was no longer a concern. In reality, the ESOP and another shareholder owned well over 50% of the company’s outstanding stock and were owed their corresponding portion of the proceeds from the company’s sale. However, Corl immediately transferred nearly the entire sale proceeds to his personal accounts and moved to Texas. To date, the employees who participated in the ESOP, all laid off after the sale of the company, have not received any portion of the sale proceeds owed to them. As indicated in the filed victim impact statements, these victims lost expected retirement income, and some have suffered serious financial distress a result.

The sentence was handed down by the Honorable Edward J. Davila, U.S. District Judge, who also sentenced Corl to pay $253,625.50 in restitution, serve a three-year period of supervised release, and pay a $100 special assessment fee. The defendant will begin serving his sentence on June 13, 2024.

Marissa Harris is the Assistant U.S. Attorney prosecuting the case with the assistance of Sahib Kaur. The prosecution is the result of a four-year investigation by the U.S. Department of Labor, Employee Benefits Security Administration.

Read More

Pedestrians and a bicyclist cross the recently completed Highway 4 Mokelumne Trail Overcrossing in Brentwood on March 20, 2024. Photos: CCTA

Transportation, city officials were joined by dozens of cyclists and pedestrians to cut the ribbon, make the inaugural walk over new $13 million bridge

BRENTWOOD, CA – Almost two years to the day of the groundbreaking, as of today, Wednesday, March 20, 2024, the Mokelumne Trail Bicycle and Pedestrian Overcrossing in Brentwood is officially open to the public.

Officials of the Contra Costa Transportation Authority (CCTA), City of Brentwood, State Route 4 Bypass Authority, Contra Costa County and Metropolitan Transportation Commission cut the ribbon to ceremonially open the recently completed bridge across Highway 4 between Lone Tree Way and Sand Creek Road.

Transportation and city officials, and former Brentwood Mayor Bob Taylor (in yellow) who first proposed the project, cut the ribbon for the opening of the Mokelumne Trail Overcrossing on March 30, 2024. Photo: CCTA

They were joined by dozens of eagerly awaiting bicyclists and pedestrians to make the inaugural bike and walk on the overcrossing. The bridge now provides safe access to bicyclists and pedestrians for commuting and recreational travel and as part of the Mokelumne Coast to Crest Trail which includes the Delta de Anza Regional Trail that runs through Antioch and Oakley..

The 850-foot bridge structure includes a wider trail-width of 16 feet to accommodate bicyclists and pedestrians using the trail or accessing a potential future transit station. The bridge also meets Americans with Disabilities Act (ADA) standards to support use by all community members. The overcrossing will also provide access to the future Brentwood Transit Center and BART Station

“The opening of the Mokelumne Pedestrian Overcrossing marks a significant milestone for alternative and innovative transportation in Contra Costa County,” said CCTA Board Chair Newell Arnerich. “The bridge was designed for the future in mind: access to future development in Brentwood as well as creating a wider pathway to someday accommodate many forms of environmentally friendly travel, including autonomous shuttle vehicles.”

Bicyclists, including advocate Bruce Ohlson (grey beard) and CCTA Executive Director Tim Haile (in blue vest) prepare to ride across the Mokelumne Trail Overcrossing following the ribbon cutting on Wed., March 20, 2024. Photo: CCTA

The overcrossing also provides a connection to the planned Innovation Center at Brentwood, a 200+ acre parcel that city officials have zoned for employer and development partners to create a workplace community.

“The City of Brentwood is proud to have partnered with CCTA on this important project, which brings greater connectivity for bicyclists and pedestrians in Eastern Contra Costa County,” said Mayor Joel Bryant. “The project complements the City’s emphasis on innovation, safety and being financially wise – no city funds were used to construct the overcrossing.”

The cost to design and build the bridge was approximately $13 million, with funding provided through Measure J taxpayer dollars, the State Route 4 Bypass Authority, and Bay Area Toll Authority (BATA) bridge toll funds.

“Closing the gap between the Mokelumne Trail by constructing a bridge to span Highway 4 was a priority project for CCTA as the overcrossing allows safe access to cyclists and pedestrians for commuting and recreational travel,” said CCTA Executive Director Tim Haile who spoke while wearing a helmet as he said rode his bike to the event and rides his bike to work every day. “This project represents CCTA’s commitment to improving mobility and furthering safe and accessible transportation for all.”

Learn more about the overcrossing by clicking here: Mokelumne Trail Bicycle/Pedestrian Overcrossing.

About the Contra Costa Transportation Authority:

The Contra Costa Transportation Authority (CCTA) is a public agency formed by Contra Costa voters in 1988 to manage the county’s transportation sales tax program and oversee countywide transportation planning efforts. With a staff of 23 people managing a multi-billion-dollar suite of projects and programs, CCTA is responsible for planning, funding, and delivering critical transportation infrastructure projects and programs that connect our communities, foster a strong economy, increase sustainability, and safely and efficiently get people where they need to go. CCTA also serves as the county’s designated Congestion Management Agency, responsible for putting programs in place to keep traffic levels manageable. More information about CCTA is available at ccta.net.

Allen D. Payton contributed to this report.

Read More